A recession is all but guaranteed, and this is finally sinking in to the market. But as stocks remain under pressure, we can shift our focus to our next moves to protect our Tax-Free Savings Account (TFSA) savings. A recession might be hard and long, but one thing that we can count on is defensive stocks. These are the stocks that survive, because they are essential businesses that we cannot go without.

Elasticity of demand

The elasticity of demand measures how demand shifts when economic factors change. These days, economic factors are changing dramatically. For example, interest rates are rising. This raises consumers’ lending costs. So, things like mortgage payments and line of credit payments increase. In turn, this reduces disposable income. At this point, consumers start looking for places to cut back on spending so they can meet essential bills like heating, food, and health expenses.

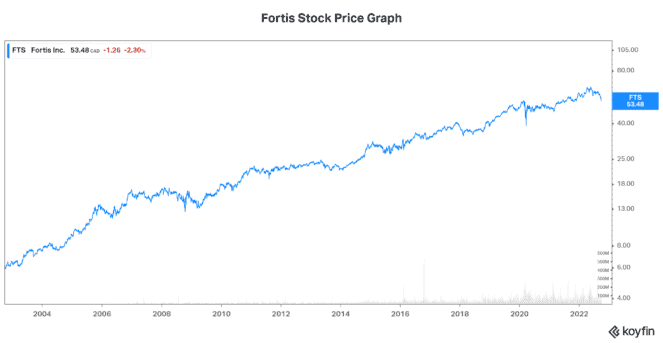

Fortis (TSX:FTS)(NYSE:FTS) is a safe utility conglomerate. Essentially, as a regulated gas and electric utility company, its revenue is safe, predictable, and resilient. This is because it’s relatively immune to economic shocks such as inflation and higher interest rates. Heating and electricity are one of the last things to be cut when consumers are faced with hard times. In fact, they are usually not cut at all. This is known as inelastic demand.

Protecting your TFSA: What recession?

With Fortis stock, we’re banking on decades of shareholder value creation. In fact, Fortis’s dividend has consistently grown for 49 years. It has not only combatted inflation but also any recession or other economic shock.

Today, Fortis stock is yielding a very respectable 4%. Importantly, this yield is backed by steady revenue and earnings growth. In fact, in its latest quarter earnings per share rose to $0.57, and operating cash flow rose to $759 million — an increase of 3.6% and 2.6%, respectively.

Similarly, we can see more of the same when we look at Fortis’s longer-term track record. For example, in the last five years, Fortis has grown its annual revenue by almost 14% — that’s a compound annual growth rate (CAGR) of 2.6%. As for operating cash flow, it has grown at a CAGR of 1%. While these numbers are not blowing the lights out, they are at least stable and consistent.

And stability and consistency are what we should be looking for at this time. This is what will get us through a recession. Ultimately, the goal right now should be on protecting our money. The downside risk looms large in the market today. Fortis stock offers much-needed protection.

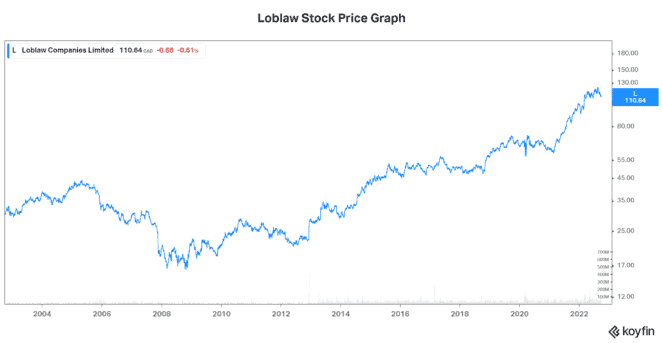

Loblaw stock: Getting defensive with food and medicine

Loblaw Companies (TSX:L) is Canada’s largest food retailer and leading pharmacy outlet. Once again, food and medical needs are two of the last things to be sacrificed when consumers are struggling financially — it really goes without saying. So, this leads me to Loblaw stock.

This stock is one of the great outperformers in 2022 — and I think this outperformance will continue. The downside risk for the market in general is significant. As we’re seeing today, investor sentiment is worsening, as talk of a recession gets increasingly louder. Loblaw is a great defensive stock that can be a shelter in this storm.

But it’s not only good downside protection. It also has good upside potential. You see, inflation is hitting food prices. Naturally, grocers (and pharmacies) have the ability to pass on their higher costs. And this brings us back to price inelasticity — and why we want to own stocks like Loblaw in our TFSA right now.

Loblaw’s latest quarter is a testament to all of this. Adjusted earnings per share rose an impressive 25%, handily beating expectations once again, which is always a good signal for future stock price performance. Similarly, free cash flow was strong in the quarter, coming in at $517 million. Going forward, Loblaw will return some of this cash to shareholders through share repurchases. The stock’s dividend yield is only 1.5%, but the share repurchases should provide support to recession guard your TFSA!