After taking an enormous blow from the pandemic, Air Canada (TSX:AC) has been one of the most popular Canadian stocks over the last few years. If you’re interested in buying Air Canada stock before its recovery, here are five of the most important things to know about it in October 2022.

Air Canada reports earnings on October 28

Earnings are key to determining how a stock will perform in the short-term, particularly in this environment. This is especially true for Air Canada stock which has been impacted for years. Solid earnings could result in significant upside, while disappointing results could cause the stock to fall in value once again.

But as you’ll see below, even if Air Canada does report strong earnings and demonstrates a continued recovery, there’s still a lot of work to do for the company to recoup all the value that’s been lost in the last two and a half years.

Air Canada stock could feel the effects of the pandemic for years

Throughout the pandemic, as Air Canada’s operations nearly ground to a halt, the stock took on tonnes of debt while diluting shares. So, while the stock offers upside as it recovers, it could be years before it reaches its pre-pandemic price upwards of $50 a share.

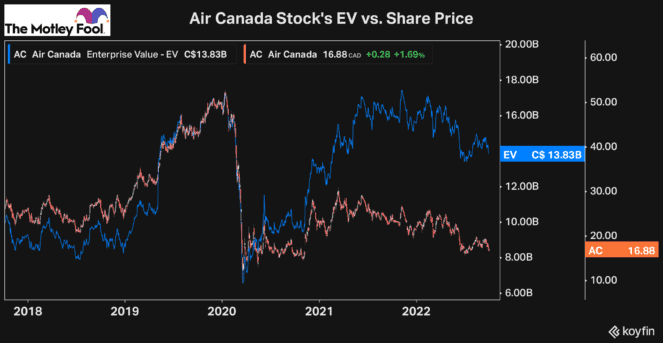

At the end of 2019, just before the pandemic, Air Canada stock had a share price of $48.51, a market cap of $12.85 billion, and an enterprise value (EV) of $16.34 billion.

As of Friday’s close, its share price of $16.60 is down roughly 66%. However, its current market cap of $5.96 billion is down just 54%, which is more of an accurate value. The share price has fallen more than the market cap due to dilution.

The best measure of all is EV since it considers debt. And Air Canada raised more cash from debt than it did from diluting shares. Its EV as of Friday is $13.83 billion, down just 15% from where it was before the pandemic at the end of 2019.

This means that Air Canada stock is not as cheap as it looks, and it has a significant amount of debt that it will need to pay down for years. This is why it’s crucial for Air Canada stock to recover its operations as soon as possible.

The airliner’s revenue has been rising for five straight quarters

The positive news for Air Canada is that for five consecutive quarters, its revenue has been higher year-over-year. And in the third quarter, which Air Canada reports at the end of this month, analysts expect a 25% increase in revenue and more than 135% in growth year-over-year.

These numbers demonstrate that Air Canada stock is on the right track. Now that its business is recovering, investor interest is shifting toward profitability.

The stock is finally expected to be profitable for the first time since the pandemic

Profitability is crucial for any business, but it’s essential for Air Canada since it has so much debt to pay down. So, with the stock expected to earn positive earnings per share (EPS) this quarter, it couldn’t come at a better time. If Air Canada successfully reports positive EPS, it would end a streak of 10 straight quarters of negative EPS.

Plus, its earnings before interest, taxes, depreciation, and amortization (EBITDA) has been recovering lately and is expected to grow to over $800 million in the quarter. So come October 28, many investors will be watching closely to see how Air Canada stock has performed.

The average analyst target price for Air Canada stock is $25.46

With an average analyst target price of nearly $25.50, Air Canada stock potentially offers more than 50% upside. It’s clear that many analysts are paying more attention to its recovery potential and worrying less about its debt.

That’s bullish for investors today who are hoping for a rally. However, if market conditions worsen or Air Canada’s recovery faces more headwinds and uncertainty, this could negatively impact the stock again in the short run.

So, while there’s significant potential for returns as Air Canada’s operations recover, it’s still unclear at this time whether those potential rewards are worth the risk.