For investors who have sweated to attain their first $100,000 in portfolio value, congrats! You are well on the way to a dream retirement. The next goal is the $1 million retirement portfolio. It represents financial independence and a lifetime of successful investment strategies.

At this stage, the power of compounding returns will aid you greatly. Keeping holdings diversified and low cost is more important than chasing growth at all costs. In addition, good behaviours, like not panic selling or timing the market, become all the more critical.

With a $100,000 portfolio, staying diversified is key. Although picking individual stocks can be a good strategy, the bulk of this portfolio is best served by low-cost exchange-trade funds, or ETFs. Today, I’ll be covering four ETFs that historically would have turned $100,000 into $1 million over 28 years.

The S&P 500 index

The S&P 500 is the most recognizable stock market index in the world. It’s used as a barometre for U.S. stock market performance and as a benchmark for professional and retail investors alike to beat. It’s also a very popular investment, with dozens of low-cost ETFs tracking it.

My favourite fund to track the S&P 500 is the Vanguard S&P 500 ETF (NYSEMKT:VOO). This ETF trades in U.S. dollars and costs a very low management expense ratio (MER) of just 0.03%. For a $100,000 investment, that works out to just $30 in annual fees.

The total U.S. stock market

The S&P 500 is a wonderful investment, but it only covers 502 large stocks. Beyond that, there’s another 3,000ish mid- and small-cap stocks comprising the remainder of the U.S. stock market. For maximum diversification, investors can also hold those in addition to the S&P 500.

A great way to invest in the total U.S. stock market is via Vanguard Total Stock Market Index ETF (NYSEMKT:VTI). VTI holds around 82% in VOO and the remainder in mid- and small-cap stocks. The two ETFs perform very similarly and cost an identical expense ratio of 0.03%.

Small-cap stocks

Small-cap stocks are those with a market capitalization (share price x outstanding shares) of anywhere from $300 million to $2 billion. As an investment, they tend to be more volatile but have historically compensated for the increased risk with higher returns.

A small-cap value ETF that had historically beaten the market is Dimensional U.S. Small Cap ETF (NYSEMKT:DFAS). Dimensional Fund Advisors excels at “factor investing” and does very well with its small-cap funds. However, DFAS costs a higher MER of 0.41%.

Small-cap value stocks

Value stocks are those that appear to be trading at a lower share price relative to their fundamentals. Things to watch for include lower than average price-to-earnings, price-to-book, and price-to-sales ratios. As with small-cap stocks, value stocks have historically beat the market over the long term.

Combining value stocks with small-cap stocks leads to small-cap value, the historically strongest performing aspect of the U.S. stock market. A great ETF to use here is Dimensional US Small Cap Value ETF (NYSEMKT:DFSV), which costs a MER of 0.31%.

The Foolish takeaway

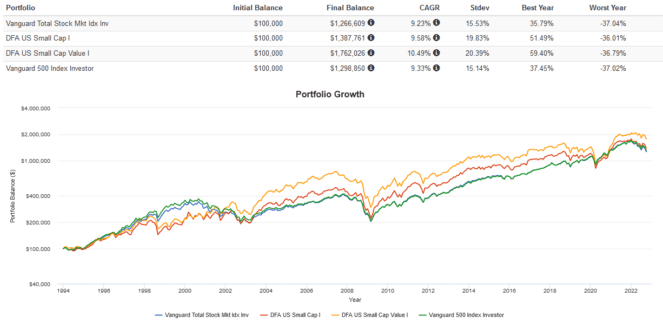

Note: the backtest results provided below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

Let’s assume you invested $100,000 in 1994 28 years ago in either VOO, VTI, DFAS, or DFSV. Keep in mind that this is just an example and the Fool recommends diversifying your portfolio. You never put another cent in, only reinvesting dividends and holding through numerous market crashes without panic selling. Here are the results:

- VOO: $1,298,850

- VTI: $1,266,609

- DFAS: $1,387,761

- DFSV: $1,762,026