After a pretty steep correction this year, plenty of dividend stocks on the TSX are trading down. As prices go down, dividend yields go up. This can be an opportunity to lock in an elevated dividend yield and a cheap stock valuation. However, it can also be risky.

Often, stocks with high dividend yields are priced that way because they have significant underlying business risks. Those risks could potentially jeopardize the sustainability of the dividend. Sometimes, an extremely high dividend yield can be a massive warning to avoid a stock.

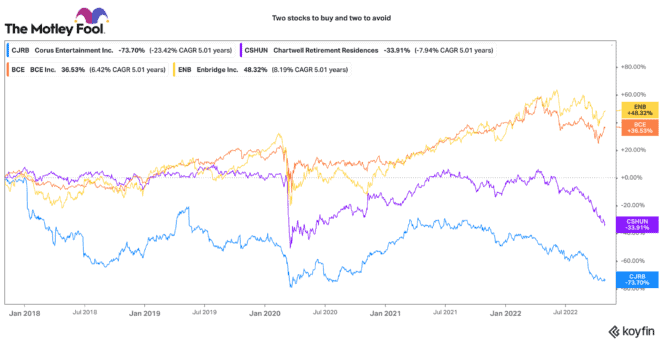

If you are interested in high dividend-paying stocks, here are two that are best to avoid and two you can safely buy today.

Cost headwinds could make this dividend unsustainable

Chartwell Retirement Residences (TSX:CSH.UN) stock is down 33% this year. With a price of $7.95 per share, it is trading with a huge 7.75% dividend yield. While this may look very attractive, investors need to be cautious.

Chartwell’s business has been seriously hit by the pandemic. After COVID-19 hit, occupancy across its residences fell from around 90% to 77% today. Yet due to inflation, staffing and operating costs have skyrocketed, as have costs related to COVID-19 protection measures.

Right now, Chartwell is not earning enough cash flows to sufficiently cover its dividend. Fortunately, it is selling off its long-term-care property portfolio, which will raise some cash and likely backstop its dividend.

However, any time a business’s cash flow is not covering the cost of its dividend, it is a huge red flag and likely a stock to avoid until fundamentals improve.

Beware of stocks with +10% dividend yields

Corus Entertainment (TSX:CJR.B) is another dividend stock with a huge yield. At a price of $2.205 per share, it yields 10.6%. Any time a dividend rises over 10%, investors should be very concerned.

Corus owns several traditional media outlets in radio and television. As concerns of a recession have risen, ad-spending has also pulled back. This has seriously impacted Corus’s business.

It just announced fourth-quarter results. Revenues declined 6%, and the company had a $367 million loss due to some goodwill write-offs.

The company has quite a lot of debt (three times net debt-to-earnings before interest, taxes, depreciation, and amortization), which is concerning given how revenues and earnings have fast declined. Given how high its current dividend yield is, the market is clearly concerned about the sustainability of its dividend.

Two blue-chip dividend stocks to ride out the storm

Two high-dividend stocks I’d have less worries about are Enbridge (TSX:ENB) and BCE (TSX:BCE). These blue-chip stocks are some of the largest on the TSX Index. They have strong balance sheets, long-dated debt, ample liquidity, and reasonable prospects for modest growth.

Enbridge pays a 6.5% dividend, and BCE pays a 6% dividend. Sure, you lose a bit of income upside from owning these stocks, but the risk of having your dividend cut is low. These businesses provide essential services (pipelines/utilities and telecommunications services) that earn resilient cash flows.

Even if the economy slows, they can slow their capital-spending plans and generate substantial free cash flows. Right now, they are set to grow earnings/cash flows by a decent mid- to high single-digit rate.

Their annual dividend rates will likely grow at the same pace. For a good income return at relatively low risk, these two top TSX dividend stocks are attractive buys right now.