2022 has been a rough ride for most TSX stocks. In fact, it’s been a year of reckoning as many stocks have had the carpet pulled out from beneath them. But thankfully, there have been some bright spots. Tourmaline Oil Corp. (TSX:TOU) stock is one of them.

Up 84% so far in 2022, is Tourmaline still a TSX stock that you should buy?

A natural gas powerhouse

Tourmaline is a Canadian mid-tier natural gas producer – the largest natural gas producer in Canada. The company is envied for its excellence in operations, which are among the best. This has resulted in a low-cost, highly efficient operation that could make money even at dismal natural gas prices. But as we know, natural gas prices are anything but dismal today.

In fact, they’ve risen astronomically in the last few years. For example, the price of natural gas traded on NYMEX (New York Mercantile Exchange) has more than doubled in the last five years. They’ve hit highs of almost $10, but are now firmly settled at around the $6 mark. But that’s just the start. Liquified natural gas (LNG) prices are even stronger. They’ve more than tripled in 2022 to the current price of more than $15.

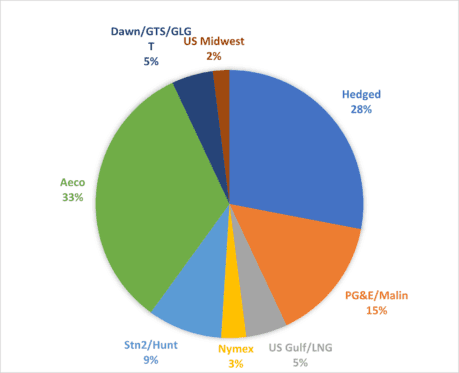

And thanks to Tourmaline’s planning and foresight, it has set itself up to be one of Canada’s leading suppliers of LNG terminals in the U.S. Thus, Tourmaline will be increasingly exposed to these strong natural gas prices.

Tourmaline stock is a TSX stock with rising shareholder returns

The TSX is down 9% so far this year. Tourmaline’s stock price (TOU) is, on the other hand, on a tear. And it’s stepping up shareholder returns as its fortunes rise. In fact, the company has committed to returning the majority of annual FCF to shareholders and is executing on that plan.

Tourmaline just reported its third quarter earnings. Once again, results were very strong. Cash flow from operations increased 38%, free cash flow increased to $1.65 per share, and dividends rose again. In fact, the company increased its regular dividend by 11% and issued another special dividend of $2.25 per share. Tourmaline will pay a total of $7.90 per share of dividends in 2022. This represents a dividend yield of more than 10% on today’s stock price.

This comes on the heels of a revised 2023 outlook given by the company back in September. In this outlook, management increased its cash flow guidance to $6.6 billion, up 28% from its previous guidance. We can see that the momentum in Tourmaline’s business is still going strong as natural gas has become very much in demand globally.

The very positive third quarter also follows a very strong first half of 2022, which saw cash flow from operations more than double. Additionally, 2022 has been a year of massive dividend payments to Tourmaline shareholders. For example, the company declared a special dividend of $2 per share in August. This followed multiple other special dividend payments as well as increases in the regular dividend.

Tourmaline’s stock price has a long runway ahead as exports of Canadian gas accelerate

The company has been working on gaining access to the strongest natural gas markets, which means strong pricing. This was the reason that it has further diversified its gas marketing portfolio by establishing a US Gulf Coast LNG pathway. To this end, Tourmaline entered into a long-term arrangement with Cheniere Energy Inc. In 2023, Tourmaline will become the first Canadian energy company participating in the LNG business with full exposure to JKM (Japan Korea Marker) pricing.

The LNG market is rapidly growing as the world looks for cheap, abundant, and secure energy. Tourmaline is positioning itself to be a natural gas provider to LNG terminals. This growth has been many years in the making, and it will likely be sustained for many years as global demand increases for natural gas.

Given these strong current and future fundamentals, Tourmaline (TOU) stock remains an attractive stock to buy.