Do you want to earn $100/month in safe, passive income? If so, I have some good news and some bad news for you.

The bad news is that you aren’t going to earn $100 per month in safe passive income with just $10,000 invested up front. That requires a 12% dividend yield or interest rate; yields that high are almost never “safe.” They come from stock and bond prices being beaten down due to perceived risk factors.

The good news is that if you’re willing to invest, say, $20,000 to $50,000, you can, in fact, get $100 in monthly passive income. $100 per month works out to $1,200 per year. You only need a 2.4% yield to get that much passive income if you invest $50,000.

In this article, I will explore three ways to get $100 in passive income each and every month.

Method #1: GICs

Guaranteed Investment Certificates (GICs) are bank-offered, bond-like investments that pay you back what you invested, plus interest, when they mature. These investments used to offer near-zero returns. However, since the Bank of Canada started raising interest rates, GIC yields have gone up.

If you invest $2,000 per month in one-year, 5% GICs starting next month and ending in December of next year, you’ll get paid back $100 each month in 2024. The extra $100 each month is pure passive income. Your total cost would be $24,000, and your total return would be $1,200.

Method #2: Rental properties

Another way to get $100 per month in passive income is to invest in rental properties. Let’s say you buy a house, take on a $1,000 monthly interest payment, and have $600 in monthly property taxes and heating costs combined. If you manage to rent the house out at $1,700 per month, then you get $100 in monthly passive income after expenses are paid.

Method #3: Dividend stocks

A third way to get $100/month is with dividend stocks like Pembina Pipeline (TSX:PPL). This is the riskiest method of attaining passive income, but it is also the most promising if it works out the way it’s supposed to.

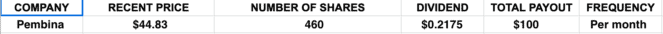

Dividend stocks pay you a certain percentage of the underlying company’s profits each month. Pembina pipeline has a 5.81% dividend yield, which is higher than any GIC offers currently. If you invest $20,700 at a 5.81% dividend yield, you’ll get approximately $1,200 in dividends each year. That works out to $100 per month. The table below shows how many Pembina shares you’d have to buy to get $100 per month from PPL stock.

Of course, with dividend stocks like Pembina Pipeline, there’s always the risk of the dividend being cut. If customers were to stop using PPL’s pipeline, storage and marketing services, its earnings would go down, and it might have to cut its dividend. However, if PPL does better than expected, then it might be able to raise its dividend. As the saying goes, extra return requires extra risk.

Foolish takeaway

As we’ve seen, there are plenty of ways to generate passive income. Some are more passive than others (you could argue that rental properties aren’t really passive, because they require work), but many can reward you handsomely over the long term. The key is to have realistic goals. If you invest $50,000, you can easily get $100 per month in passive income. If you invest $10,000, you’ll need to be more modest in your return expectations.