A big component of the financially independent, retire early (FIRE) movement is a source of passive income. Commonly, this comes from real estate in the form of a rental property. However, the housing market is red-hot these days and unattainable for many investors.

An alternative is investing using the right mix in your Tax-Free Savings Account, or TFSA. Dividends earned and withdrawals made when it comes to a TFSA are tax-free, like its name suggests. Here are some ideas on how to turn a modest $5,000 investment into $800~ of monthly income.

Getting started in your TFSA

Obviously, $5,000 isn’t enough to generate any sort of meaningful monthly passive income. Even with a very high (and risky) 10% annual yield, you’re looking at just $41.67 every month. Therefore, we have to grow our TFSA a bit before investing for passive income.

The first step to grow your TFSA is investing in quality assets that are expected to grow over the medium to long term. A great pick here is an exchange-traded fund, or ETF, like the BMO S&P 500 Index ETF (TSX:ZSP), which is both low-cost and fairly diversified.

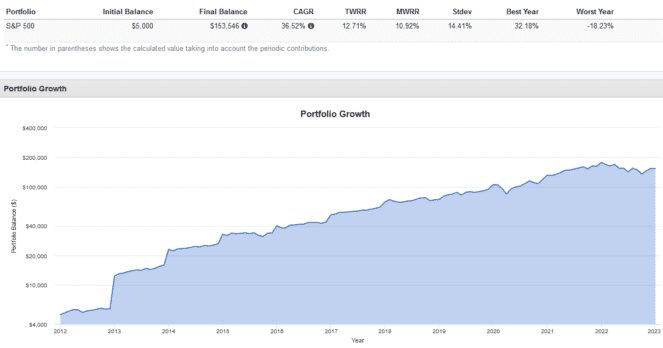

From there, all you need to do is hold steadfast, reinvest dividends, and keep up the pace of your annual TFSA contributions (the limit for 2023 is $6,500). If you did this from 2012 to 2022 (10 years), you would have turned the initial $5,000 and annual $6,500 contributions into $153,546.

Picking a monthly income-generating asset

Of course, holding for longer than 10 years would likely ensure that your final portfolio value is much, much higher thanks to the power of compounding. That being said, let’s assume you decide to call it quits while you’re still young and want to enjoy the passive income as soon as possible.

With the $153,546 in your TFSA, you could invest in the BMO Canadian High Dividend Covered Call ETF (TSX:ZWC). This ETF sells covered call options against a portfolio of Canadian dividend stocks, which converts the future share price appreciation of these stocks into an immediate cash premium.

The cash premium from the options is combined with the regular dividend income from the stocks and paid out on a monthly basis. Currently, ZWC has an annualized distribution yield of 7.02%. The ETF charges a management expense ratio of 0.72%.

Assuming ZWC’s most recent December monthly distribution of $0.10 and the current share price at time of writing of $17.35 remained consistent moving forward, an investor who buys $153,546 worth of ZWC could expect the following approximate monthly payout:

| COMPANY | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| ZWC | $17.35 | 8,849 | $0.10 | $884.90 | Monthly |