I hate to break it to you, but true passive income is not an overnight miracle sort of deal. It takes years of sustainable, long-term investing to build a big enough portfolio to pay out decent monthly income.

That being said, it isn’t impossible. By using the right assets and making prudent investment choices, any investor can turn consistent $200 monthly investments into, say, $300 of monthly income.

Our tools for this? A Tax-Free Savings Account, or TFSA, a low-cost, growth-oriented exchange-traded fund, or ETF, and a high-yield covered call ETF, and, say, 20 years of time.

Start in a TFSA

We want to keep as much of our passive income generated in our pocket as possible, so avoiding taxes (legally) is ideal. Therefore, consider making your contributions in a TFSA.

Any dividends or capital gains earned within the TFSA are tax free, as are withdrawals. Therefore, maxing this account out early on is a good idea.

If you turned 18 in 2009 and have never contributed, you can put in $88,000 in 2023. If you don’t have this much cash on hand, making small, consistent contributions like a monthly $200 works, too.

Invest for growth

We want to get our $200 monthly contribution working for us and compounding as soon as possible. Investing for income at this stage isn’t ideal. A great pick here is BMO S&P 500 Index ETF (TSX: ZSP), which is both low cost and has high growth potential.

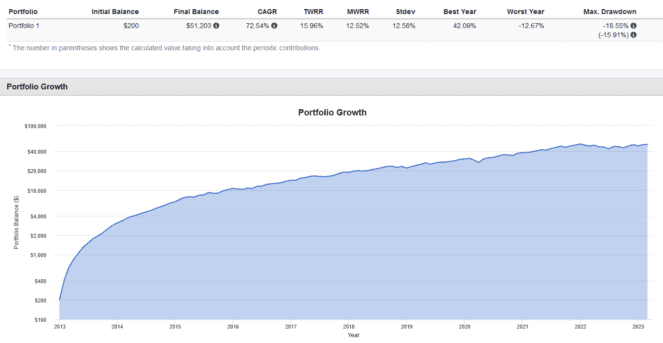

Historically, investing $200 every month into ZSP from 2013 to present would have netted you $51,203, assuming no commissions or taxes.

Keep in mind that if you’d held longer or made larger monthly contributions, your ending portfolio value would have likely been much higher. This is the power of compounding and time at play!

Invest for income

With $51,203, we can now invest in an income-oriented asset for regular monthly payments. Dividend stocks might not be a good idea here, given the high company-specific risk, quarterly dividend payments, and lower yields in most cases.

The alternative is an ETF like Harvest Healthcare Leaders Income ETF (TSX:HHL), which combines a portfolio of defensive, high-quality, large-cap U.S. healthcare stocks with a covered call overlay. Right now, the ETF yields 8.93% thanks to the covered calls.

Assuming HHL’s most recent monthly distribution of $0.0583 and current share price at the time of writing of $7.83 remained consistent moving forward, an investor who buys $51,203 worth of HHL could expect the following payout:

| COMPANY | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| HHL | $7.83 | 6,539 | $0.0583 | $381.22 | Monthly |