Investors looking to build a formidable, all-weather retirement plan portfolio shouldn’t ignore the huge returns from gold stocks and precious metals streaming stocks. Gold and precious metal streamers, including Franco-Nevada Corp (TSX:FNV) and Wheaton Precious Metals (TSX:WPM) stock, have provided low-risk exposure to commodity prices and generate positive, debt-free (un-levered) cash flows. Investors find these cash streams ever valuable during both good and bad economic times, and they may continue to do so over the next decade.

Precious metals streaming stocks can be all-weather investments. In tight contracts with mining partners, the streamers lock in very low and discounted gold and precious metal prices on future mining production. They make upfront investments and buy delivered mine production at predetermined prices, pocketing very huge spreads, cash flows, and profits. Further, they aren’t directly exposed to pure operational and financial risks faced by miners.

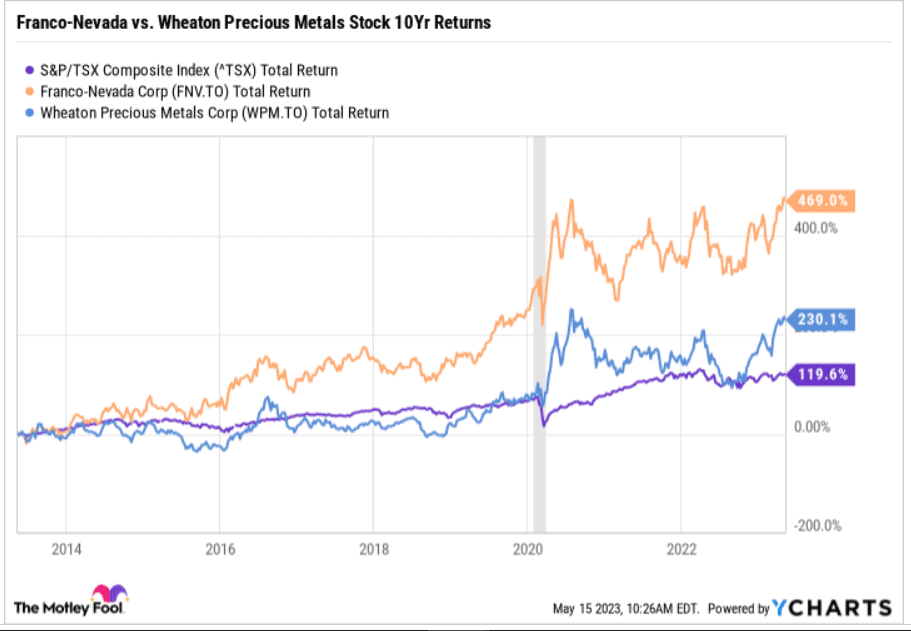

Franco-Nevada stock and Wheaton Precious Metals stock are gold and precious metals streaming stocks that have historically generated market-beating returns. Franco-Nevada stock trounced the TSX with its near 470% total returns over the past decade, while Wheaton Precious Metals stock’s 230% total return was more than the TSX’s 119.6% gain.

Investors deciding on which gold and precious metals stock to buy between Franco-Nevada and Wheaton Precious Metals stock should read further. Both stocks are profitable, cash-rich, and well-capitalized, expertly managed streaming companies with zero debt in their capital structures. Deciding which gold streaming stock to buy right now could come down to investor outlooks on the individual performances of gold, silver, and platinum group metals (PGM), as well as cobalt, and oil and gas price projections.

Why buy Franco-Nevada over Wheaton Precious Metals stock?

Franco-Nevada is a $40 billion gold and precious metals streaming giant offering investors diversified exposure to commodity prices.

Franco-Nevada stock provides investors more exposure to the gold upside than Wheaton Precious Metals stock. During the first quarter of 2023, gold represented 62% of Franco-Nevada’s total revenue, while silver sales were 11% of sales. Wheaton Precious Metals’ gold revenue was 56% of first-quarter revenue and silver represented 40% of total sales during the first three months of 2023.

Investors bullish on gold outperforming silver and other precious metals during their investment horizons may choose to invest in FNV stock over WPM stock.

Although both Franco-Nevada and Wheaton experienced double-digit year-over-year revenue declines during the first quarter, the former’s sales drop was lower, and it could recover faster. Franco-Nevada’s first-quarter revenue declined by 19%, while Wheaton reported a 30.2% sales drop. Franco Nevada’s sales were negatively impacted by lower energy prices and precious metals production disruptions. The production disruptions have since been resolved and second-quarter gold ounces equivalent (GEOs) should be higher.

Most noteworthy, the company offers the most cash flow diversification among the two streaming stocks. About 17% of its revenue during the last quarter was from oil, gas, and natural gas liquids.

FNV stock currently trades at a forward normalized price-to-earnings multiple (PE) of 41, and a forward market capitalization-to-free cash flow multiple of 36.2. Its dividend is basically customary as it yields 0.9% annually.

Why buy Wheaton Precious Metals stock instead

Wheaton Precious Metals is a $30.9 billion gold and precious metals streaming company. It generates 98% of its revenue from gold and silver sales (and 2% from cobalt), offering investors pure exposure to precious metals streaming cash flows. Franco-Nevada’s revenue is 77% from precious metals, 17% from oil and gas sales, and 6% from other sources.

There’s no oil blemish to Wheaton stock’s precious-metal glitter. ESG investors will appreciate this untainted quality.

Interestingly, Wheaton stock exhibits higher upside momentum right now. It outperformed FNV stock over the past five-year, three-year, and one-year investment horizons. Actually, WPM stock is up 29.4% so far this year to outperform Franco-Nevada stock’s 15.4% gain.

Investors bullish on silver outperforming gold during their investment horizons should buy Wheaton Precious Metals stock over Franco-Nevada. The former recently booked 40% of its sales from silver, while the latter recorded only 11%. Wheaton stock should provide better silver upside than FNV stock.

Most noteworthy, Wheaton Precious Metals stock is a tad cheaper. WPM has a normalized PE of 36.9 and a market cap-to-free cash flow multiple of 31.6. It offers a slightly better dividend yield of 1.2%.