Bombardier (TSX:BBD.B) stock has outperformed its aerospace and defence peers over the past three years, and investors may wish to buy more shares, looking forward to sustained upside momentum. However, the plane maker remains a speculative play while it repairs its balance sheet. Meanwhile, CAE (TSX:CAE) stock is another aerospace and defence industry play that could offer a more stable long-term capital growth opportunity.

Let’s explore which of the two Canadian industrial stocks should belong in your retirement plan portfolio.

Bombardier stock

Bombardier is a plane maker rising from multi-year financial doldrums. It earned credit rating upgrades from S&P Global Ratings and Moody’s Investor Services in 2023, and its stock has delivered a 375% gain in the past 36 months. Momentum is positive, but should investors buy Bombardier stock and expect the share price growth momentum to sustain?

The $5.1 billion airplane manufacturer could be a marvelous recovery story of this decade. It recently turned earnings positive, and quarterly net profits have been growing sequentially — for three consecutive quarters now. Although the business remains highly leveraged (debt comprised 44.8% of its total assets in March this year), Bombardier paid down US$400 million (about $540 million) towards reducing its astronomic $10 billion debt during the first quarter of 2023.

A US$14.8 billion order book should sustain stable revenue growth. Bombardier recently raised its financial and operating targets for 2025 to include a US$9 billion annual revenue and US$900 million in free cash flow. Its new leverage targets could take it closer to an investment-grade credit rating by 2025. More investors could fall in love with a financially healthier Bombardier stock going forward.

If the world economy doesn’t fall into a near-term recession, Bombardier’s highly cyclical business could perform well, and shares may continue to deliver desired capital gains.

That said, the company has a very bad history of destroying shareholder value and receiving government bailouts. The highly levered stock could maintain that reputation if the macroeconomy takes a dip.

Bombardier stock is thus a high-risk, high-reward investment.

Why I’d buy CAE stock instead

CAE is a $9.5 billion aerospace and defence industry stock that could be a more stable investment than Bombardier stock.

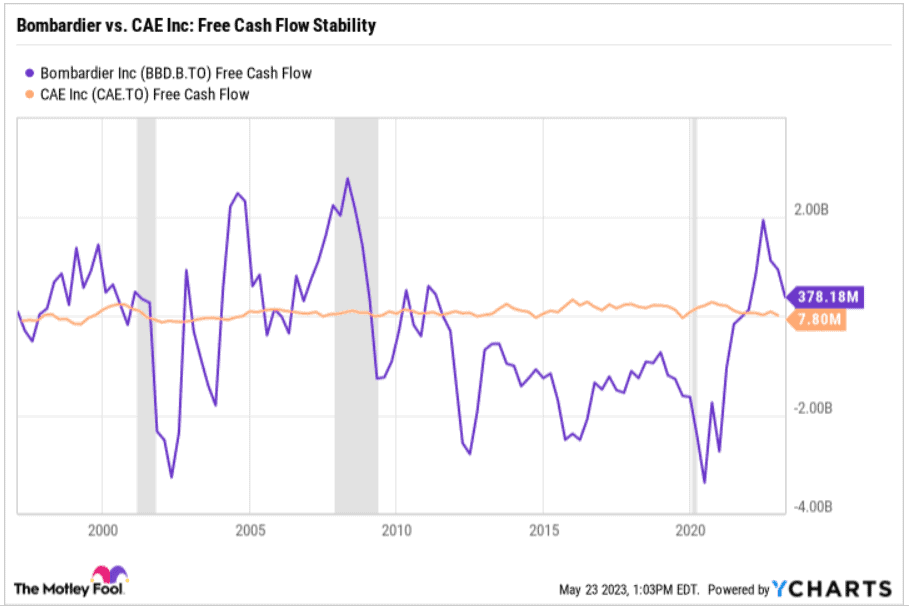

The company trains pilots, has flight simulators in more than 200 training centres across 40 countries, and it trains defence, security, and healthcare personnel, too. CAE’s business is a bit more diversified than Bombardier’s, and it has historically generated the most stable free cash flows over two decades.

I would personally be more comfortable holding a stable performer CAE stock than a speculatively promising Bombardier stock.

Although CAE and Bombardier face aviation industry revenue difficulties during economic downturns, the former’s diversity in security, defence, and healthcare industry training offers a layer of cash flow stability.

Growth is loading at CAE. The company is expanding its business reach organically through new facilities and acquisitions. A new facility in Austria is set to open in 2024, and it will be Europe’s first aviation training centre offering full flight simulators for Bombardier’s popular business jet: the Global 7500.

The company recently launched two more aviation training centres, one in Singapore (launched in November 2022) and another in Nevada (April 2023). Two more facilities will open doors in Florida, and in Georgia during the second half of 2023.

Further, CAE has lower debt leverage risks. Its long-term debt comprises under 30% of its total assets. The company generates positive free cash flow and has been profitable while Bombardier struggled.

Thus, CAE stock has a clean reputation for execution, reliable earnings generation, and steady share price growth. We can’t say the same about Bombardier stock, though the latter’s successful turnaround story could rewrite a lengthy stretch of lousy performance history.

Investor takeaway

Bombardier stock could generate life-changing returns if it meets its 2025 targets with precision, but it’s a high-risk speculative play. Its bad financial history could remain intact if a recession hits before it pays down debt to sustainable levels.

CAE stock is a stable, more diversified play that may offer steady returns and better portfolio stability. Management could reinstate the dividend it suspended in 2020 at some point.