When building a strong investment portfolio, it’s crucial not to overlook the potential value insurance companies can bring. While Canadian bank stocks often take centre stage, insurance companies such as Sun Life Financial (TSX:SLF) can be a viable way of diversifying a financial sector allocation.

The main allure for Sun Life is its steady stream of consistently above-average dividend payments, currently amounting to a forward annual yield of 4.45%. This is well above the average offered by the broad Canadian market and competitive with big bank stocks.

This dividend, reinvested into the stock and compounded over time can lead to some strong growth potential. While you can withdraw it for income or retirement needs, a reinvested dividend can pay off greatly over the long term. Here’s a look at how much a $5,000 investment in Sun Life in 2010 would be worth today.

The power of dividend compounding

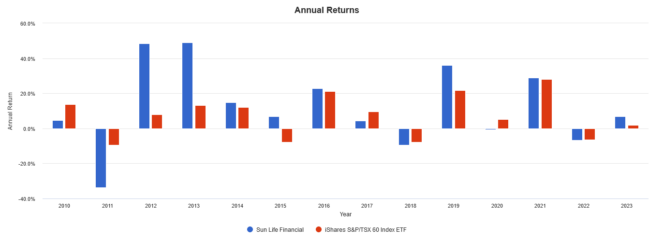

From 2010 to May 2023, a $5,000 initial investment into Sun Life would have compounded to $19,006, representing a 10.46% return. This strongly beat the benchmark S&P/TSX 60 index, which returned 7.06%.

However, there are some caveats here. Firstly, this assumes that all dividends were reinvested perfectly on time, with no leftovers. It also does not include transaction costs like bid-ask spreads and commissions.

Finally, the old saying “past performance does not predict future performance” applies here. There is no guarantee that Sun Life continues to beat the market moving forwards.

My alternative to Sun Life

As solid as Sun Life is as a stock, it is still just a single stock. I would be hesitant to bet even 10% of my portfolio on it, much less go all-in. The alternative? An exchange-traded fund (ETF).

For a more diversified approach, I would rather make a long-term investment in the average performance of the overall Canadian financial sector. My ETF pick here would be iShares S&P/TSX Capped Financials Index ETF (TSX:XFN).

Currently, Sun Life sits at 4.55% of XFN’s portfolio. The other 28 holdings include all six big banks, asset managers, other insurance companies, smaller banks, fintech companies, lenders, and even stock exchanges. All this comes at a 0.61% expense ratio, or around $61 in annual fees for a $10,000 investment.

Since April 2001 to May 2023, XFN has outperformed Sun Life strongly with a total return of 8.57% compared to 7.02%. This is a great lesson as to why backtests should be used cautiously — the time period selected can make a big difference when it comes to performance.