In 2002, if you’d had the foresight to invest $10,000 in Canadian National Railway (TSX:CNR) stock, your investment portfolio would have been one of the few out there to beat the market in the long term.

As one half of Canada’s railway duopoly, along with Canadian Pacific, CNR enjoys significant market and pricing power as a wide-moat company.

From an investment perspective, this duopolistic position also provides a significant degree of security, as the high barriers to entry in the railway sector effectively protect CNR from potential competition.

With a broad reach spanning coast to coast, CNR has been able to capitalize on the economic growth of the country, driving up its revenue and, in turn, its stock price. Here’s a look back at how CNR has been as an investment.

CNR historical performance

CNR’s excellent performance can largely be attributed to its strong, consistent record of dividend growth. Consistently increasing dividends is a clear indication of a company’s confidence in its future earnings, and CNR has been a model here.

But the consistent growth in dividends isn’t just about the income. Presently, CNR pays a very modest forward annual yield of just 2.03%. But reinvested, these growing dividends have led to significant compounding effects, further amplifying the growth of an initial investment.

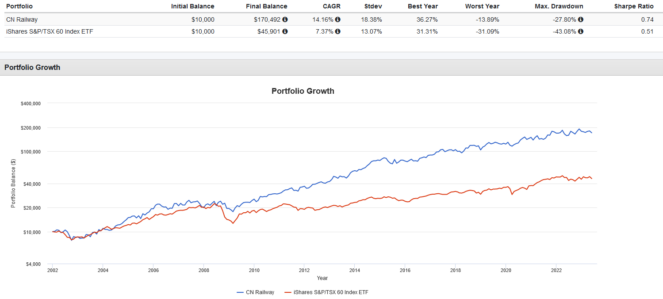

Take a look at the chart below. From 2002 to May 2023, a $10,000 investment in CNR with dividends reinvested perfectly would have grown to $170,492, representing an annualized 14.16% return. In comparison, the benchmark S&P/TSX 60 index only returned an annualized 7.37%.

There is a problem, though: this is all in hindsight. Identifying a market-beating stock of CNR’s calibre ahead of time is highly difficult. So, what can we do?

Diversify, diversify, diversify

The answer lies in the age-old practice of diversification (and no, I don’t mean just buying shares of CP). My solution here is an exchange-traded fund (ETF) like iShares Canadian Growth Index ETF (TSX:XCG).

XCG tracks the Dow Jones Canada Select Growth Index, which holds 40 large- and mid-cap Canadian stocks whose earnings are expected to grow at an above-average rate relative to peers.

Currently, CNR and CP are the third- and second-largest holdings, respectively, at 8.51% and 8.69%. The ETF pays a modest 12-month trailing dividend yield of 1.46% and charges a 0.55% expense ratio.