Omnichannel commerce solutions and payments provider Lightspeed Commerce (TSX:LSPD) is a Canadian tech stock of interest in 2023. Following an 89.2% drawdown recorded in May this year, LSPD stock has seemingly bottomed out. Shares have gained 23.3% in value so far this year. Let’s discuss whether Lightspeed could continue to run, and illuminate your investment portfolio.

Lightspeed is picking up the pieces of a scathing short seller report in late 2021 that walloped nearly 90% of its equity value. A market leader in a largely fragmented retail and restaurant software market, the company has yet to prove to an increasingly skeptical capital market that it can profitably run a software, payments, and merchant lending business while fending off increasing direct competition from Amazon and Shopify.

The good news is that Lightspeed could break even on a key metric in fiscal year 2024 (which ends in March 2024) and sustain respectable revenue growth.

Lightspeed’s narrowing losses a key inflection point?

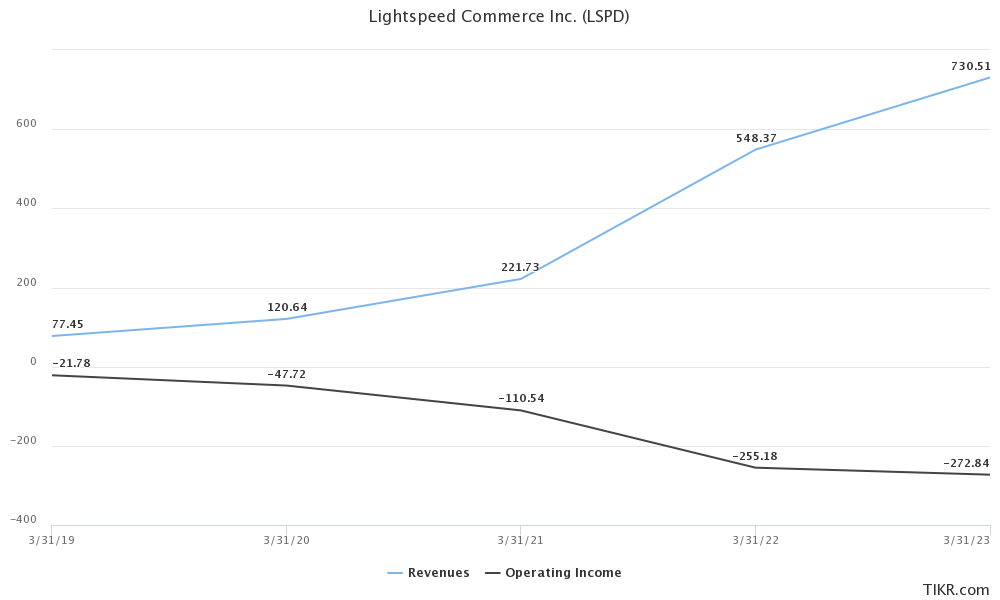

Lightspeed has been a fast-growing loss-making business for far too long, and that exposed LSPD stock to short seller attacks. Although the company still recognizes operating losses every fiscal year, losses significantly flattened out over the past 12 months. This can be seen in the graphic below.

The company is still making operating losses. However, the disturbing trend of revenue growth with ever-increasing operating losses is abating. Encouragingly, Lightspeed’s operating losses are moderating, or should I say, bottoming out.

Lightspeed is restructuring its operations this year. Management is integrating some functions, and cutting expenses on some duplicated functions accumulated during a past acquisition spree. A leaner operation will improve internal efficiencies, and reset the company for a potentially profitable future. An operationally profitable Lightspeed should attract better stock prices, and illuminate investor portfolios, especially if anticipated revenue growth rates materialize.

Watch out for sustained double-digit revenue growth

Following 33.2% year-over-year growth in annual revenue during fiscal year 2023, which ended in March, Lightspeed projects a further 21.5% increase in sales this new year to US$875–900 million. Bay Street analysts project a respectable 25.8% compound annual growth rate (CAGR) in LSPD sales over the next 24 months.

How will Lightspeed grow sales? The company enjoys strong revenue retention rates above 100%. Its recent launch of a unified point of sale (POS) and payments platform may unlock new cross-selling opportunities on acquired Ecwid customers. Further, a deliberate focus on larger retailers with annual gross transaction volumes (GTVs) of US$500 million may increase its average revenue per user (ARPU) as customers adopt more services.

The company recently launched its merchant credit services to more geographical areas, including the United Kingdom, Australia, and New Zealand, to sustain impressive merchant services growth. However, merchant services revenue still accounted for only 1.1% of annual revenue in fiscal year 2023 after a 207% annual growth rate over the past 12 months.

I would expect payment revenue to do the heavy lifting and grow corporate sales this year.

Can Lightspeed stock rise from here?

Lightspeed stock may attract better valuation multiples over the next 12 months and illuminate investor portfolios if it achieves its breakeven goal this year and maintains its cash-rich balance sheet.

Shares currently trade at a next-twelve-months’ enterprise value to revenue (NTM EV-to-Revenue) multiple of 2.2, which compares favourably to a similar-sized competitor EverCommerce, which trades at 3.9 times next year’s sales. Wall Street analysts expect EverCommerce to grow sales at a compound annual growth rate of 11.5% per year over the next 24 months, a growth rate lower than Lightspeed’s 25.8% during the same period.

LSPD stock may reclaim its lost growth stock status and revalue higher.