There’s a reason Royal Bank of Canada (TSX:RY) consistently finds itself wearing the crown on many Canadian stock market indices, like the S&P/TSX 60. Its reputation isn’t just built on its massive scale or its commanding presence in the finance world; it’s also about a track record of impressive historical performance and dividend growth that would make even the harshest critics nod in appreciation.

But let’s talk numbers, shall we? Instead of dealing in abstracts, I want to take you on a financial journey back to the turn of the century. Picture yourself taking a leap of faith and investing a neat $10,000 in RY stock on January 1, 2000. Fast forward 23 years, what would that decision look like today?

By exploring this hypothetical backtest, I aim not just to showcase the meteoric rise of RY but to highlight the transformative power of compounding, especially when you’re playing the long game with reinvesting those ever-growing dividends. I’ll also leave you with what I would invest in instead today.

Going back in time

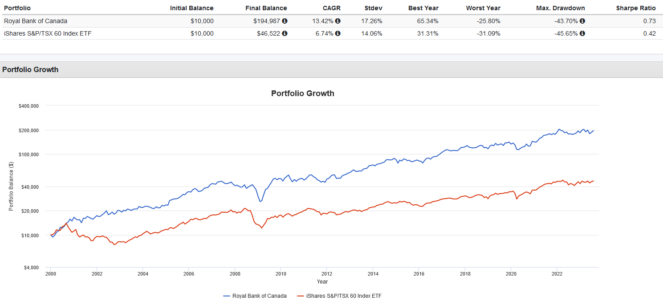

Let’s cut to the chase! Assuming you invested $10,000 in Royal Bank at the start of 2000 and held until July 2023, and further assuming that all dividends were reinvested perfectly on time and there were no transaction costs, the results would look something like this:

You would have beaten the market, as represented by iShares S&P/TSX 60 Index ETF (TSX:XIU). Your initial $10,000 investment would have grown by an annualized 13.42%, with an ending portfolio value of $194,987. That’s not bad for a bank stock.

Why I wouldn’t go all-in on Royal Bank stock

As solid as Royal Bank is, it is still just a single stock. With a single stock, even one as solid as Royal Bank, the risk of stagnation, a crash, a dividend cut, or outright bankruptcy is still too high for my liking.

Royal Bank also has some great peers I wouldn’t want to miss out on. Stocks like Toronto-Dominon Bank, Canadian Imperial Bank of Commerce, Bank of Nova Scotia, Bank of Montreal, and National Bank also deserve a close look.

So, why not buy all of them? Well, with an exchange-traded fund (ETF) like BMO Equal Weight Banks Index ETF (TSX:ZEB), you can. This ETF holds all six big bank stocks in equal weightings for a 0.28% expense ratio, making it a more broadly diversified bet on the overall banking sector. Right now, it has an annualized distribution yield of 4.83%, paid on a monthly basis.