The stock market has been oscillating up and down in a sideways channel. The general idea is to buy the dip, but it may be easier said than done. Some folks like to stay the course and average into their stock positions over time whenever they have extra money coming in that they don’t need for a long time.

If you have been buying stocks year to date, chances are that some of your positions are in the red. Particularly, some stocks sensitive to higher interest rates have been hit harder, including real estate investment trusts (REITs) and utility stocks.

The Canadian bank stocks have also performed worse than the market, as the economic outlook has been more negative with higher interest rates that are dampening economic growth. In fact, some economists believe we’re heading for a soft-landing recession by 2024.

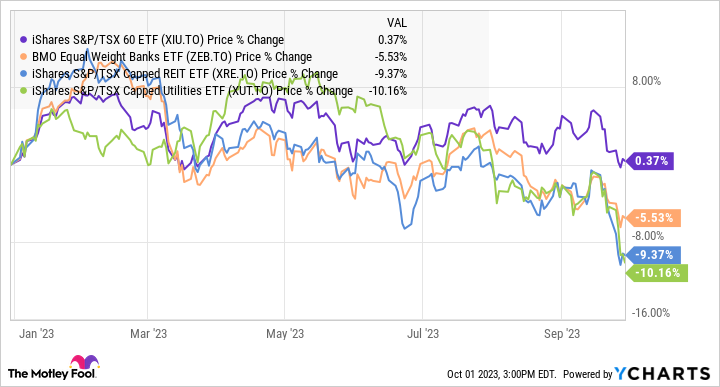

The chart below illustrates the year-to-date price action of the Canadian stock market using iShares S&P/TSX 60 Index ETF (TSX:XIU) as a proxy compared to the respective exchange-traded funds (ETFs) that represent the Canadian banking, Canadian REIT, and Canadian utility sectors.

XIU, ZEB, XRE, and XUT data by YCharts

Even the cushion from the relatively high cash distributions of these sectors was not sufficient to cover the (temporary) price loss. Yes, the emphasis is on the temporary price loss. Assuming you bought units in the ETFs or shares in quality businesses in the sectors, the stock price should come back eventually.

XIU, ZEB, XRE, and XUT Total Return Level data by YCharts

Investors have to be patient. In the worst-case scenario, for a more sustainable rally, one might have to wait until the Bank of Canada sees it necessary to cut the policy interest rate to boost economic growth in a bad recession. This is why it’s so critical to only consider investing long-term capital in the stock market as well as target to buy wonderful businesses at good valuations.

The utility ETF, iShares S&P/TSX Capped Utilities Index ETF, has been the worst performer year to date. If investors sell at a loss now or worse, in a bear market, they lose out. It could take a long time to recover one’s losses. Notably, it might be a bad idea to add to your worst losers. You might think you’re buying on the cheap, but the worst losers are probably trading cheaply for a reason.

The best thing to do is to stay the course — that is, stay invested according to your risk tolerance and long-term financial goals. Today, investors are probably leaning towards risk-off investing to prioritize capital preservation and weighing more in lower-risk investments, including cash, quality bonds, and low-risk stocks.

Low-risk stocks include those that trade at reasonable valuations and continue to deliver earnings or cash flow growth. Of course, those that also pay out nice dividends provide an extra layer of safety for investors. The key idea is to stay the course and invest in a diversified portfolio. A diversified stock portfolio would include a basket of stocks from different sectors and industries that are exposed to different risks.