Maximizing our Tax-Free Savings Account, or TFSA, contribution limit is a necessary sacrifice that pays dividends down the road — literally. Tax-free dividend income is one of the great advantages of the TFSA. So, how can we maximize those dividends and set ourselves up well for retirement with monthly income?

Well, here are two dividend stocks that can help you do just that.

Energy stocks are paying generous dividends

I’ve chosen to focus here on high-yielding energy stocks that I believe are unjustifiably cheap and backed by strong cash flows and fundamentals. They are both in the energy industry, and they both have dividend yields above 7.5%.

Consider them as you attempt to take full advantage of the TFSA contribution limit in 2023.

Freehold Royalties: A TFSA stock yielding 7.5%

As a royalty company, Freehold Royalties (TSX:FRU) avoids many of the risks that are inherent in the oil and gas business. For example, oil and gas producers must take on all of the exploration risk and expense. Similarly, oil and gas companies must invest capital to keep their production going. These costs are subject to inflation, they reduce profitability, and they must be paid regardless of commodity prices.

Freehold Royalties, however, is not responsible for any of these expenses. The company simply collects royalties on its land holdings and distributes them to its shareholders. So, Freehold has an advantage as it strives to “deliver growth and lower risk attractive returns to shareholders over the long term.”

Freehold is currently yielding a very generous 7.5%. In the last three years, Freehold’s annual dividend has increased 500% to $0.36 per share. The dividend is paid monthly, and, in fact, Freehold has been paying a dividend for two decades.

Peyto: A 9.4% yield for your tax-free TFSA income

Another energy stock that pays a monthly dividend is Peyto Exploration and Development (TSX:PEY). Peyto is a Canadian natural gas producer that operates in a very prolific basin: the Alberta Deep Basin. This basin is characterized by higher recoveries, lower risk, and more predictability. It is these characteristics that drive Peyto’s strong results and steady dividend.

Peyto is currently yielding a very generous 9.4%. With a healthy balance sheet and strong margins and returns, Peyto looks very good on a medium-term basis. It remains one of the lowest-cost natural gas producers, and this, combined with its strong financial performance, makes Peyto a good option for monthly dividend income.

Also, the North American natural gas market is looking forward to some really strong fundamentals. It’s no longer just a North American market. The natural gas market has been opened to global markets, as liquified natural gas (LNG) exports are finally gaining steam and volumes. This is an extra demand boost that has increased the value of North American natural gas astronomically.

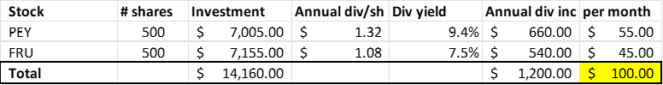

The details: How to generate $100 each month

As you can see in the slide below, assuming you invest $14,160 and split it 50/50 in the two stocks, you will generate $100 of monthly dividend income each month.

The bottom line

In closing, I’ll just highlight the fact that energy stocks are cyclical stocks. They do well in rising commodity price environments and not so well in falling commodity price environments. Yet, despite this, the companies I’ve discussed in this article both have very favourable risk/reward tradeoffs, with many risk-mitigating characteristics that leave me comfortable recommending them.

In any case, oil and gas fundamentals continue to look good. So, if we snatch up these high yields now, we can maximize our dividend income as we strive to reach the TFSA contribution limit in 2023.