It’s official, the Tax-Free Savings Account (TFSA) contribution room for 2024 is $7,000. Canadians who were eligible to contribute towards a TFSA since its inception in 2009 could have a total cumulative TFSA contribution room of up to $95,000 in 2024 – a significant capital position with which one can design an investment portfolio that generates decent monthly passive income streams of $558 per month.

The good news for income-oriented TFSA investors in 2024 is that most income-producing asset classes trade cheaply right now.

Bond yields and distribution yields on Canadian Real Estate Investment Trusts (REITs) look more attractive this December than they were two years ago. If the Bank of Canada holds rates flat through 2024, Canadian dividend stocks and preferred shares may shine as discount rates remain stable next year.

Depending on how much risk one is willing (and able) to take to receive recurring monthly passive income from a TFSA, I will discuss two investment allocation approaches that may generate up to $558 a month in passive income in 2024. The first involves buying a moderate-risk diversified exchange-traded fund (ETF) and the second option involves direct investments in Canadian monthly dividend stocks. This income-growing strategy works best if one buys dividend aristocrats.

Buy Canadian dividend stocks with proven track records

To generate recurring passive income every month in a TFSA, you could invest in well-established dividend-paying companies with long track records of sustainably raising their dividends every year.

One good example is First National Financial (TSX:FN) stock, a $2.3 billion well-established Canadian mortgage originator that recently grew quarterly revenue by 43%. This lender has managed to grow its mortgage portfolio by 10% year over year to a record $141.9 billion by September 2023. Higher interest rates and pauses in rate hikes have been favourable to the business lately, and the company declared a special dividend last month.

An investment in First National Financial stock could pay you a stream of $0.204 per share in dividends every month yielding 6.3% annually. The non-bank financial stock has raised dividends every year for 11 consecutive years, and its payout is well covered by recurring earnings.

Most noteworthy, in good years (and these are usually plenty), FN stock pays a variable special dividend at year-end. The special dividend went as high as $1.25 per share in 2021. You can’t bank on the special dividend recurring; however, investors have received special payouts in four of the most recent five years.

Harvest low-risk dividends every month from an ETF

Canadian investors could widely diversify their holdings across common stocks, corporate bonds, preferred shares, and Real Estate Investment Trusts (REITs) through a single investment in iShares Canadian Financial Monthly Income ETF (TSX:FIE) and earn up to $558 per month in a TFSA account – tax-free.

Created in 2010, the ETF has $930 million in net assets managed by Blackrock – it’s widely popular among income-oriented investors for two good reasons – it pays high-yield dividends every month, and has a moderate risk profile due to its diversification into fixed-income assets and preferred shares.

Investors buying the ETF today gain wide diversification into three asset classes in one go. The portfolio has a 9.9% allocation to Canadian corporate bonds, 19.7% to preferred stock (a sub-asset class that usually pays higher dividend yields than common shares), and 5% to real estate – a trusted income-producing asset class. The rest of its holdings are in high-quality Canadian dividend stocks.

Unlike typical pure common stock ETFs, the fund is a moderate-risk investment for regular monthly income. However, the fund is somewhat of an actively managed ETF, and so has a moderately high management expense ratio (MER) of 0.85%; you pay about $8.50 each year for every $1,000 invested. Investors usually receive a 7.3% dividend yield.

How to earn $558 per month in TFSA passive income

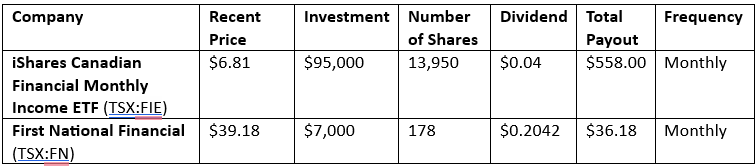

In just one transaction, a TFSA investor could potentially buy 13,950 shares in the iShares Canadian Financial Monthly Income ETF for about $95,000 in 2024 and earn $558 each month in moderate-risk TFSA passive income.

As the table below shows, theoretically, a $7,000 TFSA contribution for 2024 could buy 178 shares of First National Financial and generate more than $36 per month in passive income. However, whatever your conviction level is, it is advisable to always diversify investment holdings over several different stocks from different economic sectors to reduce portfolio (and income) risk.