When it comes to Canadian banks, it would be a good idea to pay attention to Toronto-Dominion Bank (TSX:TD). This is because this bank has proven itself to be at the top of its game, both in terms of risk management and growth. As we look ahead to 2024, let’s remind ourselves of how TD Bank stock has enriched its shareholders over the last few years.

A history of excellence at TD Bank

Through the credit crisis of 2008, the recession in the early 1990s, and so many more negative events, TD Bank has survived and ultimately thrived. The bank has grown into a financial force in the US, with a strong presence in banking and an increasing share of wealth management. In short, TD Bank has been a great example of the value of Canadian banks.

But this could not be accomplished without a strong financial base to spring from. In fact, TD Bank has been well capitalized over the years. The bank has maintained a policy that is conducive to this by avoiding high risk businesses and maintaining a conservatism that keeps it grounded.

The lessons that we investors can learn from this are twofold. First, we should value reliability and consistency. Second, we should look for companies that display strong financial management as well as a degree of conservatism.

Q4 results: Higher loan loss provisions

This conservatism is evident in difficult times, such as today. Rising interest rates have put a strain on consumers and lenders alike. As loan losses are escalating, those banks that have strong financial health and solid lending practices, such as TD Bank, will come out relatively unscathed.

In TD’s latest quarter, adjusted revenue increased 8%, which is a testament to the bank’s brand, capabilities, and growth strategy. In fact, the bank’s U.S. business continues to have a lot of growth ahead. While the short-term outlook is not so good, with rising expenses and continued economic uncertainty, TD Bank has stood the test of time. This means that any upcoming weakness will likely be a good opportunity to buy TD Bank.

TD stock: Dividends plus capital appreciation

Shareholders of TD Bank stock have not only had exposure to strong capital gains, but also years of safe, reliable, and growing dividends. In fact, since 2013, the stock has paid out total dividends of $30 per share. But what about the total picture?

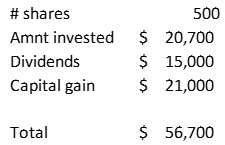

Well, as you can see from the table below, TD Bank stock has been a great investment over the last 10 years.

During this time period, TD’s stock price doubled and dividends grew at a compound annual growth rate of 8.5%. If you had invested $20,000 in the stock back then, you would have bought 500 shares. This would have given you dividend income of $15,000 and a capital gain of $21,000. Your $20,000 would now be worth $56,700, for a total return of 183%.

The bottom line

Looking at a long history of a stock’s performance can be a good indication of what to expect in the future. While it’s certainly not a guarantee, it can help us understand a company, its business, and its resiliency.