The extreme volatility that retail commerce software and payments platform vendor Lightspeed Commerce (TSX:LSPD) stock has witnessed since its initial public offering (IPO) makes extrapolations of potential investment returns highly subjective.

If you invested $10,000 in Lightspeed stock at its IPO in 2018, you would have about $13,100 in your account today. Investors who invested the same amount near the tech stock’s peak, which happened just before a catastrophic short-seller attack in September 2021, could have experienced significant capital losses. They could have lost as much as 89% of capital at worst or retained a $1,700 account balance today.

That said, investors who bought $10,000 worth of LSPD stock in January 2023, betting on its strong recovery potential, could have grown their capital to nearly $13,000 today.

Bearish investors may view the recent recovery in Lightspeed stock price as akin to a dead-cat bounce — a temporary recovery on an asset doomed to fail completely. However, signs are emerging that the tech stock has turned a corner.

Investors bullish on the company’s sustained valuation recovery may find inspiration from a widely successful Canadian tech stock that has minted millionaires.

One inspiring recovery story is CGI, another Canadian domestic stock, which experienced similar drawdowns to Lightspeed stock when the dot.com bubble burst between 2000 and 2003. Investors who bought CGI stock at its IPO and held onto their CGI stock through the trough (an 80% loss) could be sitting on a $3.5 million position today or a staggering 34,500% holding period return.

Significant drawdowns may happen on top growth stocks, too. CGI stock has successfully recovered past all-time highs over the past 20 years to mint new millionaires.

Could Lightspeed stock make new millionaires, too?

Long-term-oriented investors could feel more comfortable holding Lightspeed stock now than ever before. Truth be told, the business isn’t as sustainably profitable or generating positive cash flows as that of CGI to sustain a new round of accretive acquisitions yet. While it’s still too early to expect a millionaire-maker status, the company has the potential to make a strong comeback, given its new operating trajectory,

Lightspeed is currently engineering a strong recovery. Corporate restructuring efforts, which began with a halt to its aggressive acquisitions-led growth strategy and included management changes, are beginning to bear fruits. Recent cost cuts and market repositioning attempts have created a new sustainable growth path that could lift Lightspeed stock in the future.

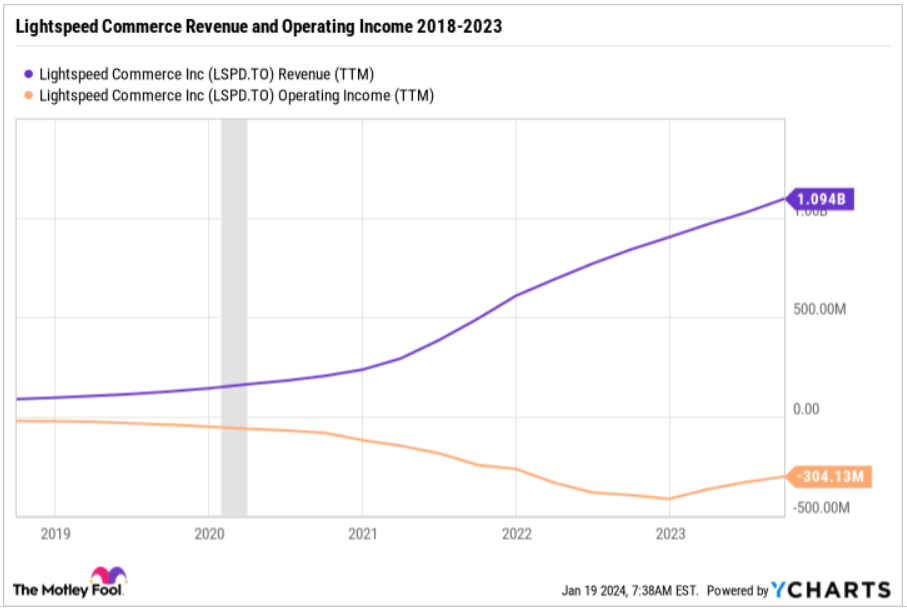

Lightspeed’s turnaround in 2023 can be summarized in a graphic below.

The company sustained double-digit revenue growth rates through the first nine months of 2023 without any costly acquisitions. Cost cuts are working, and for the first time since its IPO, the company’s operating costs have narrowed during the past 12 months.

An operating breakeven at the adjusted earnings before interest, taxes, depreciation, and amortization (adjusted EBITDA) level in 2024 should help the company generate positive free cash flow — a critical ingredient for sustainable growth.

Meanwhile, Lightspeed’s balance sheet remains intact with a $1 billion cash treasure trove that’s powering merchant lending efforts and generating significant interest income to augment corporate investment budgets.

Stock may outperform in 2024

Valued at a price-to-sales (P/S) multiple of 3.5, or nearly half its industry’s P/S multiple of 6.5, Lightspeed stock could fetch better value in 2024 should it maintain double-digit revenue growth rates and consistently report positive quarterly adjusted EBITDA results throughout this new year.

To be rational, the road to minting new millionaires may still be long and winding. Given time and consistency, Lightspeed stock could potentially sustain a positive share price growth over the next five years as the business matures profitably.