Today, I’m diving straight into a no-brainer retirement strategy that, had it been followed from 1985 to 2024, could have potentially made you a millionaire with a simple buy-and-hold approach.

This strategy revolves around a single exchange-traded fund (ETF), demonstrating the power of long-term investing and the remarkable potential of compounding returns. It’s a strategy that underscores the value of patience, consistency, and the astuteness of selecting the right investment vehicle.

Here’s how exactly it works and an ETF pick to put it in play.

Buy and hold this index fund

The strategy is straightforward yet incredibly powerful.

Start with an initial investment of $500 and then contribute $500 each month, totalling $6,000 annually. This amount is well within the reach of many investors, especially considering it’s less than the current $7,000 TFSA limit.

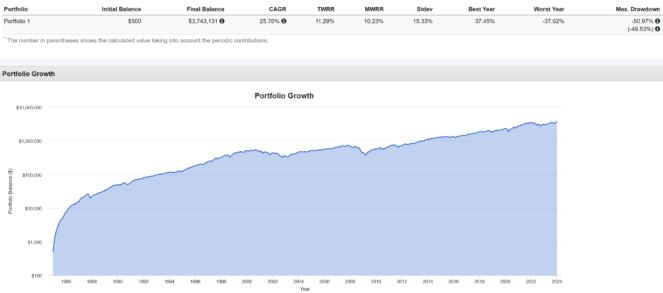

Historically speaking, if this strategy had been implemented from 1985 to 2024, it would have grown into a staggering $3,743,131. This remarkable growth is primarily due to the magic of compounding returns and dividends — all harnessed through a low-cost S&P 500 index fund.

Compounding returns work by earning returns not just on your initial investment but also on the returns that the investment has already generated. Over time, this effect snowballs, significantly increasing the value of your investment. When you add dividends to this mix, especially if they’re reinvested, the growth potential becomes even more pronounced.

The choice of a low-cost S&P 500 index fund is crucial. These funds typically have low management expense ratios and offer exposure to 500 of the largest U.S. companies, providing a balanced and diversified investment in some of the world’s most successful companies.

Which ETF to buy

The ETF that I recommend for this strategy is BMO S&P 500 Index ETF (TSX:ZSP). This choice is particularly well suited for investors looking to implement a long-term buy-and-hold approach.

ZSP tracks the S&P 500, buying and holding all the stocks in the S&P 500. When you buy a share of ZSP, you are effectively gaining exposure to the returns of these companies, spreading your investment across a wide range of sectors and reducing your risk compared to investing in individual stocks.

An added benefit of ZSP is that it pays quarterly dividends. These dividends can be reinvested to further enhance the compounding effect on your investment. Additionally, ZSP is known for its affordability, charging an annual expense ratio of just 0.09%. This low fee ensures that more of your money remains invested and growing over time.

The strategy with ZSP is straightforward: buy and hold, consistently invest, and reinvest dividends. This approach is as simple as it is effective, requiring minimal effort on your part while offering the potential for significant long-term growth. It’s a strategy that relies on the proven track record of the S&P 500 and the power of compound growth.