If you’re currently sitting on a pile of cash, perhaps feeling quite content with a risk-free 5% yield, it’s time for a reality check. While that return might seem attractive on the surface, it’s essential to consider the long-term implications, especially regarding inflation.

Over time, inflation can erode the purchasing power of your cash holdings, meaning that in real terms, you’re not actually earning as much as you think. In fact, you’re likely losing ground financially.

Moreover, by waiting for a market pullback with the S&P 500 at all-time highs, you’re engaging in market timing – a strategy that countless financial experts advise against. The rationale is straightforward: consistently predicting market movements is nearly impossible, even for seasoned investors.

Historical evidence overwhelmingly suggests that attempting to time the market often results in missed opportunities and can significantly impair your investment returns over the long haul. Here’s why waiting for the “perfect” moment to invest might not be the wisest strategy.

Cash is a terrible long-term investment

The term “risk-free” investment often brings to mind the safety of holding cash, but when we adjust for inflation, “risk-free” translates to nearly “return-free” over the long term.

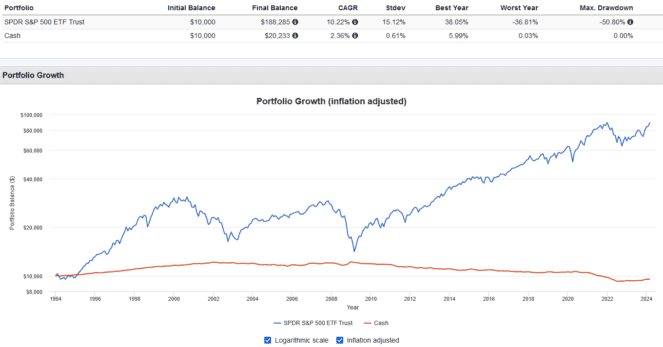

Let’s consider the numbers: from 1994 to the present, the S&P 500 has delivered an annualized return of 10.2%, while cash investments have returned a mere 2.4% on average.

However, these are nominal returns. When we adjust for inflation to calculate the real returns – the returns that actually matter to your purchasing power – the picture changes dramatically.

The S&P 500’s real return drops to 7.5%, which still represents significant growth. On the other hand, the real return for cash plummets to -0.15%. What this reveals is that, over three decades, holding cash hasn’t just resulted in stagnation; it’s actually amounted to a slight loss in real terms.

Even though the S&P 500 has experienced severe downturns, such as the 50% losses during the dot-com bubble and the 2008 financial crisis, its long-term performance has remained robust. In contrast, cash, despite its allure of safety, has failed to keep pace with inflation, leading to no real wealth generation.

It’s OK to invest at all-time highs

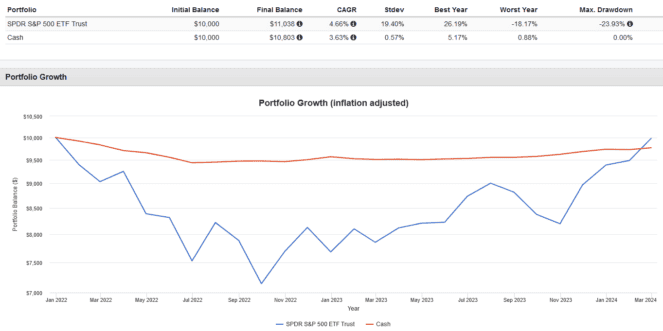

Many investors recall the bull market that surged during the COVID-19 pandemic and came to an abrupt halt in 2022. This period raises a question: what if an investor had decided to invest a lump sum into the S&P 500 right at the start of 2022, at the previous all-time high just before the bear market hit?

Despite the bear market and the rising interest rates that followed, which increased yields on cash and cash equivalents, an investor who chose to stay invested in the S&P 500 through these tumultuous times would have fared better than if they had sat on cash.

By resisting the urge to sell during the bear market and instead continuing to reinvest dividends, this hypothetical investor would not only have recovered from the initial losses but also outpaced the returns that cash could have offered during the same period.

The lesson? Stop worrying about what Mr. Market is doing and practice consistently dollar-cost averaging into a low-cost S&P 500 index fund, like the BMO S&P 500 Index ETF (TSX:ZSP).