When I talk about investing “safely” in AI (artificial intelligence), I’m really focusing on avoiding the classic pitfall of getting stuck with shares in a single AI company that doesn’t pan out.

While “safe” might sound reassuring, remember that investing in stocks—especially in a sector as volatile as AI—will still expose you to significant ups and downs, and you may see some unrealized losses along the way.

With that caution in mind, a more prudent approach to tapping into the AI boom is through AI thematic exchange-traded funds (ETFs).

These funds offer a broader, more diversified exposure and are managed by professionals who can navigate the complexities of this rapidly evolving industry.

Here are two top AI ETF picks that stand out in today’s market.

Evolve ETFs

The first ETF that stands out is Evolve Artificial Intelligence Fund (TSX:ARTI).

This ETF takes a unique approach by combining active management with cutting-edge technology—its portfolio is selected not just by human expertise but with the assistance of an AI system provided by Boosted.AI.

This integration of generative AI helps in analyzing a vast array of data across hundreds of stocks, showcasing a forward-thinking method of asset management that could become more prevalent.

Currently, ARTI manages a portfolio of 61 stocks and charges a management fee of 0.60%. For a peek into the composition of this ETF, here are the top holdings as of July 9:

Global X ETFs

If you’re leaning towards a more traditional, passively managed investment, consider Global X Artificial Intelligence & Technology Index ETF (TSX:AIGO).

The ETF tracks the Indxx Artificial Intelligence & Big Data Index and charges a cheaper management fee of 0.49%.

Although it’s a newer addition to the Canadian market, AIGO essentially functions by holding shares of its U.S.-listed counterpart, which has a solid track record.

This structure allows Canadian investors to gain exposure to AI technologies without the hassle of currency conversion.

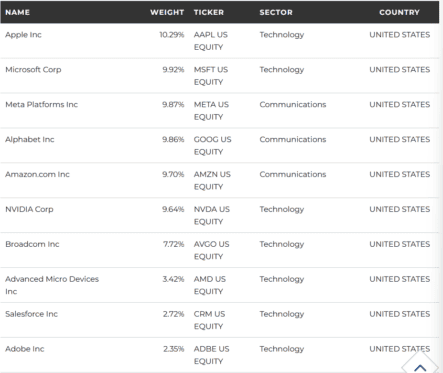

Its portfolio includes a diverse range of companies that are leading in AI and technology sectors. Here are some of the top holdings included in this ETF:

The Foolish takeaway

Both ARTI and AIGO offer a more diversified approach to AI exposure compared to picking individual AI stocks. This is because they spread risk across a basket of companies rather than concentrating it in one—making them relatively safer.

However, it’s important to note that neither ETF is necessarily safer than a broad stock market ETF. Thematic ETFs are more susceptible to sector-specific downturns compared to ETFs that cover a wider range of industries.

So, before making a purchase, really consider your risk tolerance. Ask yourself whether the AI exposure you already have through broad market indices like the S&P 500 is sufficient for your investment goals and whether it’s worth paying higher fees for specialized AI thematic ETFs.