You’ve likely heard the buzz about something called artificial intelligence, or AI. Maybe you’ve even tinkered with ChatGPT or Dall-e, tools that can generate text and images with a bit of clever coding.

It’s fascinating stuff, but when it comes to investing in AI, where do you even begin? Picking individual AI-themed stocks and managing a portfolio might seem hard, but there’s a simpler approach that doesn’t require you to become an expert overnight.

In my view, the easiest and perhaps most effective way to tap into the AI boom is to let an exchange-traded fund (ETF) do the heavy lifting. Here’s why that makes sense.

Why use an ETF?

Investing in AI means you’re aiming to capitalize on the growth of the entire theme, not just a couple of standout companies. AI’s influence stretches across various sectors, not limited to the tech firms that might come to mind first.

Consider whether your AI investments should only include tech companies focused on developing AI or if it makes sense to also include healthcare firms using AI for surgeries or companies that create the data centres and chips that power AI.

Navigating this broad landscape can be complex because it’s about more than picking stocks—it’s about understanding which parts of AI you believe will be most impactful. Using an ETF simplifies this significantly.

It provides a diversified portfolio across different aspects of AI, all selected and managed by experts who understand the sector’s dynamics. This way, you can invest broadly in AI without needing to make all the detailed decisions yourself.

An AI ETF to watch

If you’re looking for a targeted AI investment, consider Evolve Artificial Intelligence Fund (TSX:ARTI), which made its debut as Canada’s first AI-focused ETF in March 2024.

What sets ARTI apart is its use of a generative AI platform called Boosted.ai. This platform is designed to screen and score potential investment targets, focusing on companies poised to significantly benefit from AI technology.

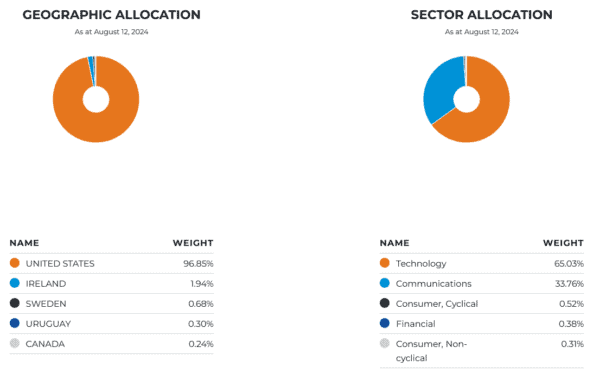

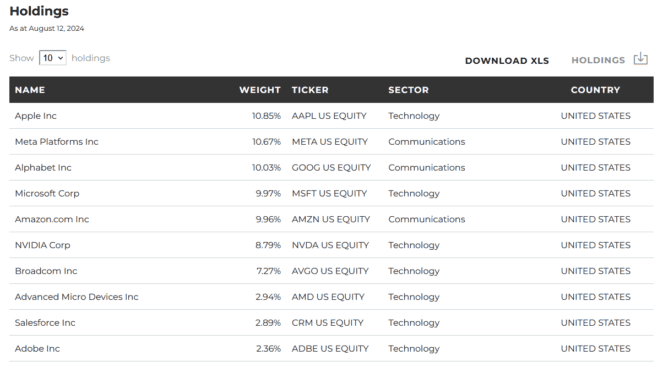

ARTI maintains a portfolio of 61 stocks featuring a range of companies that are integral to the AI industry. You can see its geographic dispersion, sector composition and top holdings below:

However, investing in this ETF comes with costs. ARTI charges a management fee of 0.60%, which translates to $60 annually for every $10,000 invested.

Given its specialized nature, it’s best used as a complementary investment alongside a more traditional core portfolio, such as one consisting of Canadian dividend stocks.