I’ll get to the point: picking individual stocks in the artificial intelligence (AI) sector is highly risky. The odds of finding the next big winner are low, and even if the sector thrives, there’s no guarantee your chosen stock will.

Instead of gambling on single stocks, a smarter move is to invest in the broader AI theme. This approach mitigates some of the risks and still allows you to capitalize on the sector’s potential growth. Here’s a look at a few ways you can do this.

First way: Buy CDRs

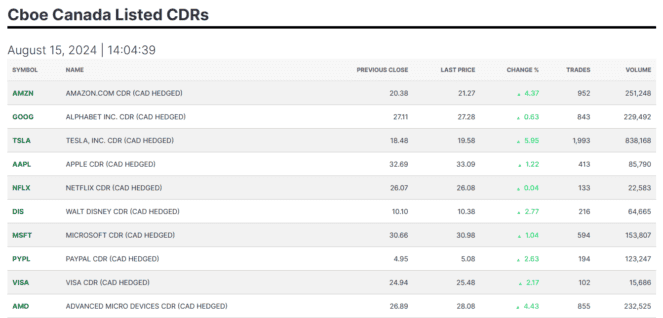

If you don’t mind trading a few stocks, you can assemble an AI-themed portfolio without needing to convert Canadian dollars (CAD) to U.S. dollars (USD), thanks to Canadian Depositary Receipts (CDRs).

CDRs are essentially Canadian versions of popular U.S. stocks. They trade in CAD, often at a lower share price per unit.

This setup includes up to a 0.50% annual currency hedging fee and a 15% withholding tax on dividends, but depending on your brokerage, this can be more economical than converting to USD.

The current list of CDRs includes quite a few semiconductor and software companies involved in AI, as seen below:

AI ETF

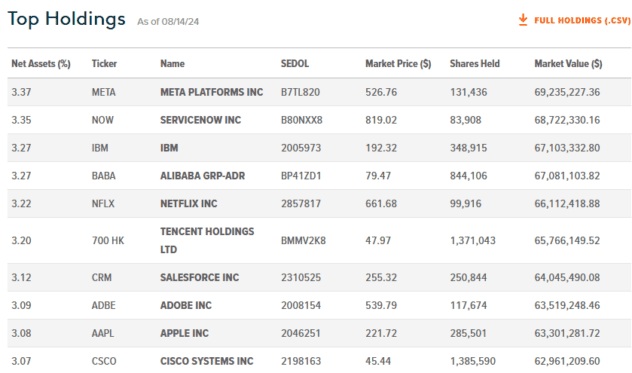

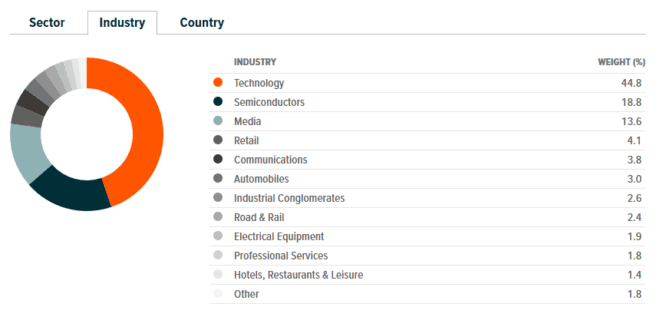

If you prefer a more hands-off approach, consider investing in an exchange-traded fund (ETF) that focuses on AI stocks. A prime example is the Global X Artificial Intelligence & Technology Index ETF (TSX:AIGO).

This ETF charges a 0.49% management fee to track the Indxx Artificial Intelligence & Big Data Index. It’s also cost-effective; as of August 15, shares of AIGO trade at around $20. Here are the ETF’s current top holdings, country, and sector exposure:

The Foolish takeaway

If you opt for method one, focusing on CDRs, make sure you achieve sufficient diversification. Do thorough research on how different CDR stocks are involved in AI and aim to include a variety from various sectors.

However, if you choose the ETF route, you benefit from built-in diversification, but you’ll have less flexibility to customize its holdings. Weigh these factors carefully when deciding how best to gain exposure to AI.