Looking to invest in something straightforward and globally recognized? Consider The Coca-Cola Company (NYSE:KO), a standout choice and one of the few single stocks I personally hold.

I personally think investing $1,000 in Coca-Cola, particularly within a Registered Retirement Savings Plan (RRSP), is a smart move, as it bypasses the typical 15% foreign withholding tax on U.S. dividends, maximizing your potential returns.

Here’s some of the reasons why Coca-Cola could be your top pick right now.

It’s a well-run, quality company

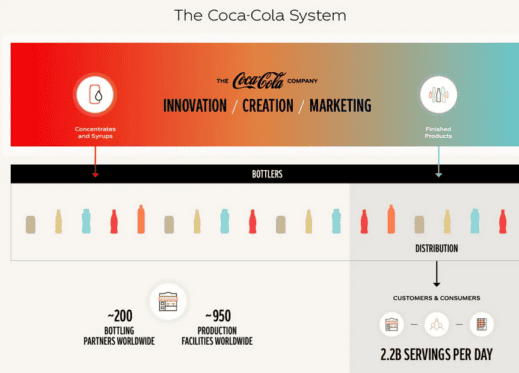

Coca-Cola operates under a unique business model known as the “Coca-Cola System,” which involves producing its syrup at a very low cost and distributing it to bottlers who have exclusive territorial contracts.

This system allows Coca-Cola to maintain some of the strongest profit margins in the beverage industry, with a profit margin of 22.9% and an operating margin of 32.4%. These margins indicate how much of each dollar earned is converted into profits, showcasing the company’s efficiency.

Speaking of efficiency, Coca-Cola’s Return on Equity (ROE) is an impressive 38.8%. ROE measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested.

An ROE of 38.8% is exceptionally high, indicating that Coca-Cola is not only profitable but also very effective at using its capital to generate earnings.

Moreover, for those looking for a “sleep well at night” stock, Coca-Cola fits the bill with a beta of 0.6. Beta is a measure of a stock’s volatility in relation to the overall market. A beta less than 1 means the stock is less volatile than the market, making Coca-Cola a more stable and less risky investment compared to broader market movements.

It’s a very shareholder-friendly company

Founded in 1892, with the first Coca-Cola beverage actually served in 1886, Coca-Cola is undeniably a mature company.

Owning a mature company often means benefiting from capital being returned to shareholders in various ways, such as through buybacks and dividends. Coca-Cola excels in the latter, being particularly renowned for its consistent dividends.

Coca-Cola is a celebrated dividend king, boasting over 50 years of consecutive dividend increases. Presently, it pays a quarterly dividend of $0.485 per share and has averaged a 3.8% annual increase over the last five years.

While this increase rate might not be the fastest, it has consistently outpaced inflation, demonstrating the company’s commitment to delivering shareholder value.

Moreover, Coca-Cola’s approach to shareholder value extends beyond dividends. The company has also implemented share splits over the years.

A single share purchased in 1919 would be equivalent to 9,216 shares today, showcasing the long-term growth and rewarding nature of investing in Coca-Cola.

It might be undervalued

In my view, Coca-Cola might currently be undervalued despite its run-up year-to-date. The forward price-to-earnings (P/E) ratio, a measure that helps gauge the valuation of a company, stands at 22.7.

If we inverse this number, we get the earnings yield, which is about 4.4%. This metric is particularly insightful – it shows the percentage of each dollar invested that was earned by the company during the period.

When you compare Coca-Cola’s earnings yield to the current yield of the 10-year U.S. Treasury bond, which is around 4%, Coca-Cola’s shares appear attractively priced. This is especially relevant in an environment where interest rates are declining, making lower-risk income alternatives like bonds less attractive.

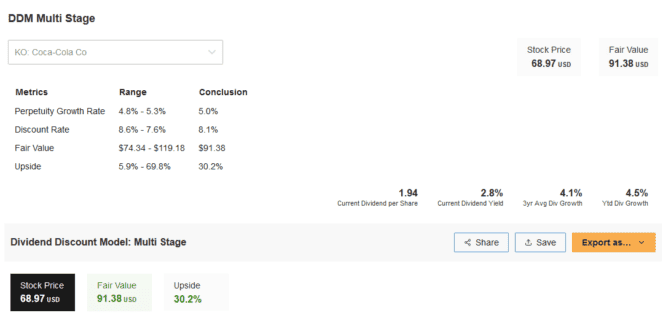

I’ve also used a discounted dividend model (DDM) to estimate Coca-Cola’s intrinsic value. This model helps factor in expected dividend payments and growth rates to determine a fair stock price.

According to my calculations, Coca-Cola’s fair value is approximately $91.38 USD, which suggests a potential upside of 30.2% from the current share price of $68.97.

Taking all these points into consideration, it’s clear why I’m bullish on Coca-Cola and why it remains a part of my personal investment portfolio.