Dividend policies among companies can vary widely. Some firms prefer to retain all their excess cash as a buffer, while others reinvest it into growth. Some opt for share buybacks, and others distribute it back to shareholders, typically on a quarterly basis, though sometimes monthly.

For an example of the latter, there’s a lesser-known TSX-listed company you might not have heard of: Exchange Income Corporation (TSX:EIF).

Here’s what you need to know and a breakdown of how much monthly passive income you could potentially earn with it.

What is Exchange Income?

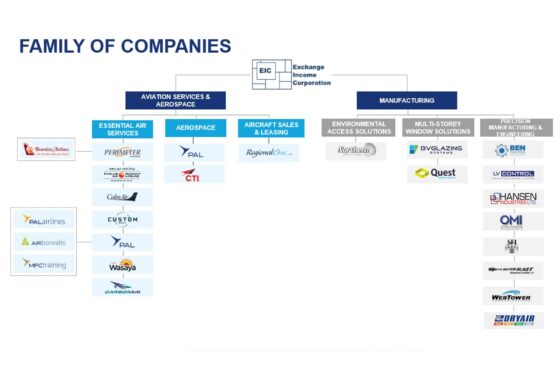

Exchange Income is a holding company, which is distinct from an operating company. This type of enterprise is established primarily to own shares in other private companies rather than manage them directly.

The primary aim here is to form a corporate entity that buys up various businesses and then redistributes the cash flows from these companies to its shareholders — this is the essence of Exchange Income.

So, what does it own? Exchange Income boasts a diverse portfolio of private Canadian aerospace and manufacturing companies. Many of these companies might not be household names, but they are essential to Canadian industrials.

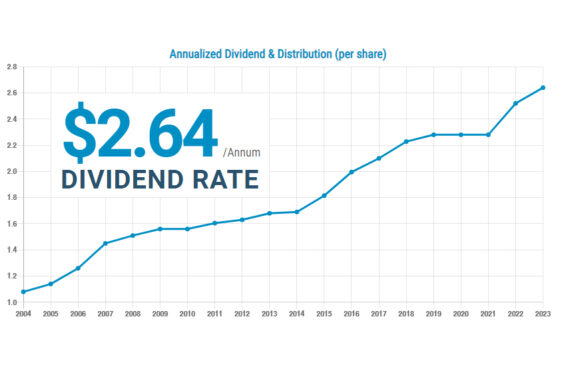

Since its inception in 2004, Exchange Income has increased its dividend 17 times, with a compound annual growth rate (CAGR) of about 5%. Currently, the dividend stands at $2.64 per share annually, which translates to a yield of 4.73%.

And yes, it pays monthly, with the next ex-dividend date scheduled for November 30 and the dividend payable on December 13 at $0.22 per share.

How much monthly passive income could you earn?

Assuming EIF’s next monthly distribution of $0.22 and a share price of $55.30 as of November 19 remained consistent moving forward, an investor using a TFSA would need to buy roughly $55,300 worth of EIF, corresponding to 1,000 shares to receive around $220 monthly tax-free.

| Stock | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| EIF | $55.30 | 1,000 | $0.22 | $220 | Monthly |