It turns out the Tax-Free Savings Account (TFSA) is pretty underused by Canadians despite its many advantages.

I blame the name. Calling it a “savings account” causes some people to treat it like a regular bank account, leaving it to hold cash instead of tapping into its full potential. That’s a missed opportunity because the TFSA is incredibly versatile.

Shockingly, according to Advisor.ca, the average fair market value of a TFSA for Canadians aged 30 to 34 is just $15,347. While that might sound decent, it’s far below what you could be building in this account.

Consider this: if you were born in 1991, have been a resident of Canada since before 2010, and have never contributed to your TFSA, the maximum contribution room for 2024 is a whopping $95,000, according to Moneysense. By 2025, you’ll get another $7,000 in contribution room.

If you’ve been slacking on using your TFSA or aren’t sure how to maximize its growth potential, keep reading. I’ll show you how to make the most of this powerful tool for building your wealth.

Why invest in a TFSA?

The TFSA offers advantages that neither non-registered accounts nor the Registered Retirement Savings Plan (RRSP) can match.

Unlike a non-registered account, where you need to report and pay tax on interest, dividends, and capital gains, the TFSA lets these grow completely tax-free. You don’t even have to include them on your tax return. Plus, you can withdraw funds whenever you need, with no penalties — though your contributions are capped annually.

While RRSPs also allow tax-free growth of interest, dividends, and capital gains, withdrawals are where the differences start. Withdrawing early from an RRSP triggers a penalty, and once it’s converted into a Registered Retirement Income Fund (RRIF) in retirement, withdrawals are taxed as income.

Every dollar you hand over to the Canada Revenue Agency (CRA) is one less for your pocket. If you want to maximize the power of compounding and keep more of your returns, prioritizing contributions to your TFSA is a smart move.

How to maximize growth in a TFSA

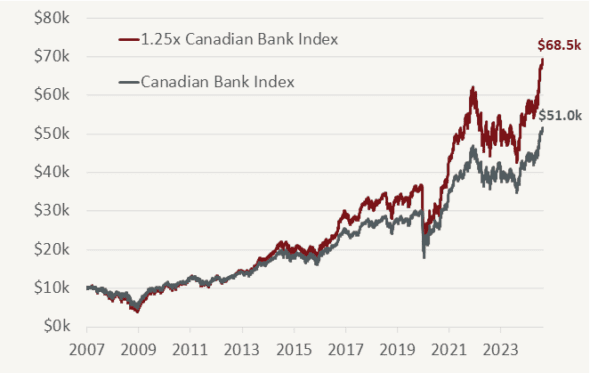

If you’re a fan of Canada’s big bank stocks and looking to amplify your returns within a TFSA, here’s an intriguing strategy: consider investing in them with 1.25 times leverage. This means for every $100 you invest, an additional $25 is borrowed to increase your market exposure.

Typically, borrowing to invest (using margin) isn’t allowed within a TFSA; that’s reserved for non-registered accounts. While you could take out a line of credit to fund your TFSA, this approach carries risks and often comes with high interest rates.

The solution: Hamilton Enhanced Canadian Bank ETF (TSX:HCAL), which offers a way to gain leveraged exposure to Canada’s major banks without the complexities of personal borrowing.

Here’s how it works: for every $100 in assets, HCAL borrows an additional $25, resulting in $125 of exposure evenly distributed among Canada’s “Big Six” banks.

This strategy can lead to higher potential gains and increased yields. As of October 31, 2024, HCAL boasts a yield of 6.37%, with distributions paid monthly.

However, it’s important to note that leveraging also amplifies volatility. On days when bank stocks decline, HCAL may experience more significant drops. As with any investment, higher potential rewards come with increased risks.