According to Moneysense, if you were born in 1991, have been a resident of Canada since before 2010, and have never contributed to a Tax-Free Savings Account (TFSA), your total contribution room for 2024 is $95,000. That’s a huge opportunity to grow your money tax-free.

Looking ahead, the contribution limit for 2025 will be another $7,000. But if you haven’t contributed to your TFSA for 2024 yet, start there first – another $7,000 is up for grabs.

There are countless ways to invest your TFSA contribution. My idea today could offer you either growth or income with just one exchange-traded fund (ETF). It all depends on how you choose to handle the monthly distributions it provides.

Bank stocks: A TFSA favourite

Canada’s “Big Six” banks – Royal Bank of Canada, Toronto-Dominion Bank, Bank of Nova Scotia, Bank of Montreal, Canadian Imperial Bank of Commerce, and National Bank of Canada – are perfect candidates for your TFSA.

Why? As a group, these banks boast strong balance sheets, operate in a highly regulated environment, and have a century-long history of paying and increasing dividends. They also form an oligopoly, dominating Canada’s banking industry and benefiting from stable, recurring revenues.

When you hold these bank stocks in a TFSA, the dividends and any capital gains grow entirely tax-free. Plus, unlike U.S. stocks, there’s no 15% foreign withholding tax deducted from your dividend yield. It’s a win-win for long-term investors.

If you love bank stocks, you’ll love this ETF

Ever wanted more exposure to Canada’s big banks? In a non-registered account, you can borrow money using a margin loan to boost your investment.

For example, if you hold $10,000 in bank stocks, your broker might let you borrow an additional 25%, increasing your exposure to $12,500.

But in a TFSA, borrowing money directly to invest isn’t allowed. But there’s a next-best alternative: the Hamilton Enhanced Canadian Bank ETF (TSX:HCAL).

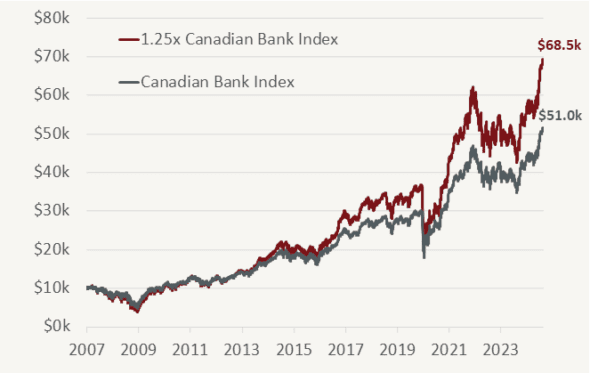

HCAL takes the same concept of leveraging and applies it within an ETF. For every $100 in assets, HCAL borrows an additional $25, giving you $125 worth of exposure. No margin loan needed!

The fund spreads this leverage across Canada’s “Big Six” banks, amplifying both the potential risk and reward. If you’re bullish on Canada’s banking sector, HCAL’s strategy has historically been a way to outperform the individual stocks.

On top of the potential for higher returns, HCAL offers an impressive yield – currently paying 6.4%. This yield is distributed monthly, and you have the flexibility to reinvest it for compounding growth or withdraw it as tax-free passive income in a TFSA.