According to recent data, the average Canadian aged 54 has a Tax-Free Savings Account (TFSA) balance of $45,000 to $55,000. Let’s call it $50,000 for simplicity.

This is a far cry from what the maximum contribution room could be. If you were born in 1991, have been a resident of Canada since before 2010, and have never contributed, your total TFSA contribution room for 2024 is $95,000. Plus, you’ll get another $7,000 of room in 2025.

If you’re around 54 years old and sitting on a $50,000 to $55,000 balance, you’ve got two options. You can either focus on growth to boost long-term value or optimize it for passive income generation – especially if early retirement is on your mind. Here are two ETF picks tailored for both strategies.

Investing for growth

If you don’t need income from your TFSA, consider putting your $50,000 into an index ETF like the iShares S&P/TSX 60 Index ETF (TSX:XIU).

XIU holds 60 blue-chip Canadian companies with a portfolio dominated by the banking and energy sectors – exactly what you’d expect from Canada’s largest and most established businesses. It also comes with a reasonable management expense ratio (MER) of just 0.18%, making it a cost-effective choice.

If your goal is to retire at 64, that gives you a 10-year time horizon. From November 18, 2014, to November 18, 2024, XIU, with dividends reinvested, compounded at an annualized rate of 8.8%. At that rate, your $50,000 could grow to $116,128.95 in 10 years.

Investing for income

If you’re looking to achieve FIRE – Financial Independence, Retire Early – your $50,000 TFSA can help provide a monthly, tax-free passive income boost. An excellent ETF for this purpose is the Hamilton Enhanced Multi-Sector Covered Call ETF (TSX:HDIV).

HDIV holds several Hamilton ETFs designed to closely mimic the composition of the S&P/TSX 60 Index. However, it goes a step further by employing 1.25x leverage and writing covered calls to enhance its income potential.

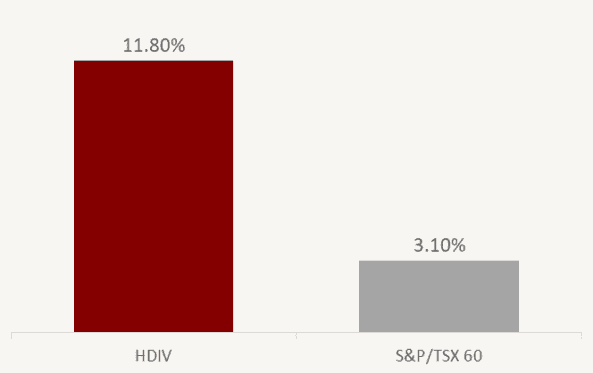

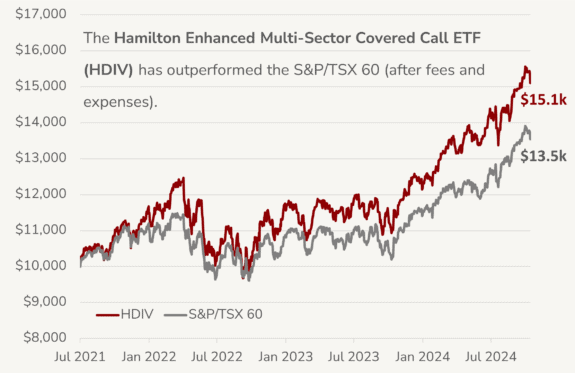

Currently, HDIV offers a remarkable 11.8% annualized yield. Interestingly, HDIV’s total return (with distributions reinvested) net of fees has even outperformed the index since its inception, something that’s very hard for actively managed ETFs to do.

With a $50k TFSA, you could buy 2,785 whole shares of HDIV based on its November 20th price of $17.95. Assuming its last monthly distribution of $0.171 per share remains steady moving forward, you could generate $476.24 per month of tax-free passive income.

| ETF | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| HDIV | $17.95 | 2,785 | $0.171 | $476.23 | Monthly |