Did you know the average Tax-Free Savings Account (TFSA) balance for Canadians aged 64 is around $150,000? That’s according to a 2023 study by the Canadian Institute of Chartered Accountants (CICA).

Now, $150,000 on its own probably isn’t enough to carry you through retirement. But it’s an excellent tool for boosting your Registered Retirement Income Fund (RRIF) withdrawals, Canada Pension Plan (CPP) benefits, and Old Age Security (OAS) payments with some tax-free income.

To make the most of it, you’ll need the right exchange-traded fund (ETF)—something that pays monthly income without too much volatility. At age 64, with a shorter time horizon and lower risk tolerance, stability matters more than ever.

Luckily, iShares has an ETF that fits the bill perfectly. Here’s how it works and how much monthly, tax-free income you could generate from a $150,000 TFSA with it.

iShares Canadian Financial Monthly Income ETF

Debuting in April 2010, iShares Canadian Financial Monthly Income ETF (TSX:FIE) is one of the longest-standing Canadian income ETFs still trading today.

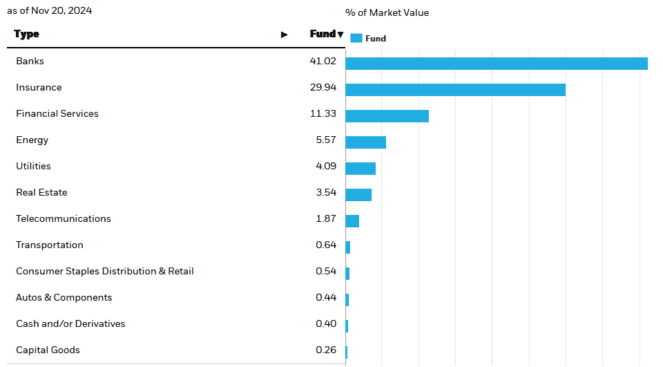

FIE operates as a fund of funds, holding approximately 20% in preferred share ETFs, 10% in corporate bond ETFs, and the remaining 70% in Canadian financial stocks. This includes all six big banks, major insurance companies, and a few others, such as asset managers, lenders, and stock exchanges.

The fund generates income from dividends paid by the financial stocks and preferred shares, along with interest from corporate bonds. Together, these sources currently provide a yield of 5.86% as of November 21.

FIE does have its limitations. Its diversification is restricted due to its focus on the financial sector and the Canadian market. Additionally, its management expense ratio (MER) of 0.75% is relatively high, though not uncommon for income-focused funds.

How much you could earn with a $150k TFSA

As of writing, FIE trades at $8.20 per share. A $150,000 TFSA can, therefore, purchase 18,292 whole shares. Assuming its last distribution per share of $0.04 stays consistent, that works out to $731.68 monthly or $8,780.16 annually in tax-free passive income via a TFSA, along with the potential for modest share price growth.

| ETF | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| FIE | $8.20 | 18,292 | $0.04 | $731.68 | Monthly |