The Tax-Free Savings Account (TFSA)—a registered account that lets your investments grow tax-free—just got its 2025 contribution limit announcement: a cool $7,000.

But if you haven’t maxed out your TFSA for 2024 yet, don’t wait! This year, you’re also eligible to contribute $7,000.

Since TFSA contribution room is limited, it’s important to be strategic. The last thing you want is to suffer a capital loss in your TFSA, as you won’t be able to claim that loss on your taxes like you could in a non-registered account.

That said, it’s okay to take calculated risks in pursuit of higher returns. Here’s one unique ETF that offers the potential for both high growth and monthly income—entirely tax-free in your TFSA.

One drawback of the TFSA

If you want to take on more risk prudently in your TFSA, picking single stocks might not be the best option. Instead, consider leveraging your investments to potentially amplify returns.

In a non-registered account, this often involves using margin. For instance, if you have $10,000 in a non-registered account, you could borrow an additional 25%, giving you $12,500 of market exposure. This amplifies both your gains and losses, as your returns are based on the larger amount you control.

However, you can’t do this in a TFSA. Brokers don’t offer margin loans for TFSAs, so leveraging directly within the account isn’t an option. While it’s technically possible to take out an external loan and fund your TFSA, today’s high interest rates make this an impractical choice for most investors.

Fortunately, there’s an ETF solution designed to offer leverage within your TFSA.

A 1.25x Canadian Banks ETF

Hamilton Enhanced Canadian Bank ETF (TSX:HCAL) offers investors a unique way to gain increased exposure to Canada’s banking sector.

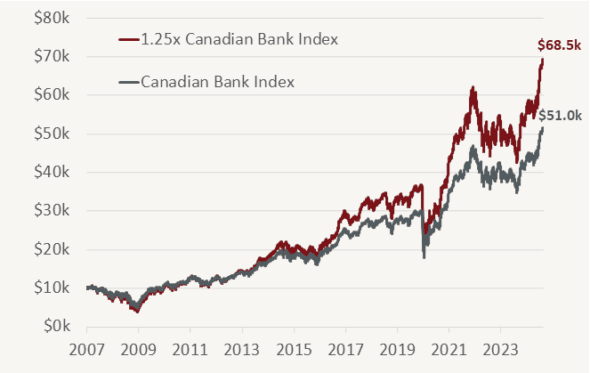

It holds an equal-weighted portfolio of Canada’s “Big Six” banks and applies a modest 25% leverage, or 1.25x, to boost performance.

The strategy is straightforward: invest a bit more into high-quality blue-chip stocks. Historically, this approach has performed well, given the stability and reliable dividends of Canadian banks.

What sets HCAL apart is that it doesn’t require a margin account, and it’s fully eligible for a TFSA. Hamilton manages the borrowing on their end, securing better institutional rates than individual investors.

Leverage amplifies both growth and risk, but it also enhances income. Currently, HCAL pays a 6.37% annualized distribution yield with monthly payouts.