The TSX is filled with stocks that can help set us up with a sizable passive-income stream. We just have to find them and put an investment plan into action.

It’s true that money can’t buy happiness. But it can certainly help us come closer to it because money can buy us comfort. And if we achieve financial freedom, it can buy us time: the most precious and valuable resource there is.

Here are two TSX stocks to buy for passive income to help you get closer to financial freedom.

Northwest Healthcare Properties

It’s true that Northwest Healthcare Properties REIT (TSX:NWH.UN) has had a rough couple of years. And this might make us nervous to invest in this 8.1%-yielding stock. But I would suggest that we should reconsider.

If we look into the main reasons Northwest got into trouble, we find that it was due to management’s decision to spread the company too thin. Acquisitions were made globally, debt was piled on to fund these acquisitions, and then interest rates shot up quite rapidly. So, it was the perfect storm in a sense. This led to a dividend cut and to Northwest Healthcare’s stock price falling from highs of over $14 in 2022 to under $5 today.

But at this point, Northwest has been actively trying to regroup and come back from those days. New management was put into place. Non-core properties were divested. Debt was restructured and paid down. Today, Northwest stands in a much better position moving forward.

This means it can benefit from what is a very strong environment for its properties. Northwest is the owner and operator of a portfolio of medical office buildings and healthcare real estate. By definition, its business is not economically sensitive, and it’s relatively stable. The population’s healthcare needs drive the demand for healthcare assets. And this is something that Northwest has going for it.

Telus

Telus (TSX:T) is currently yielding 8.3%. The company has a long and enviable dividend history of reliability and growth. In fact, over the last 10 years, Telus stock’s dividend has doubled. This represents a compound annual growth rate (CAGR) of 7.2%.

A healthy balance sheet and strong cash flow generation back the company’s growing dividend. While the payout ratio is high, at more than 160%, dividends are easily covered by operating cash flows, which is good. The payout ratio is calculated by taking the total dividends paid and dividing it by basic earnings. The dividend represents only 40% of cash flow.

In its latest quarter (Q3/24), Telus posted a 9.6% increase in its operating cash flow and a 12% increase in its adjusted earnings per share (EPS). The company’s drive to lower costs, as well as a steady rise in revenue, reflecting strong demand, drove these results.

As a telecom company, Telus stock has the advantage of earnings predictability, economic insensitivity, and a strong competitive advantage.

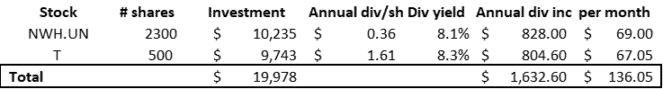

Investing $20,000 in TSX stocks for passive income

As you can see from the table below, investing roughly half of the $20,000 into each of these TSX stocks generates $1,632 in annual dividend income or passive income. This equates to $136.05 of passive income per month.

The bottom line

Getting your money to work for you is the ultimate goal when trying to secure the financial freedom that most of us dream about. The two TSX dividend stocks discussed in this article can take you a long way toward achieving it.