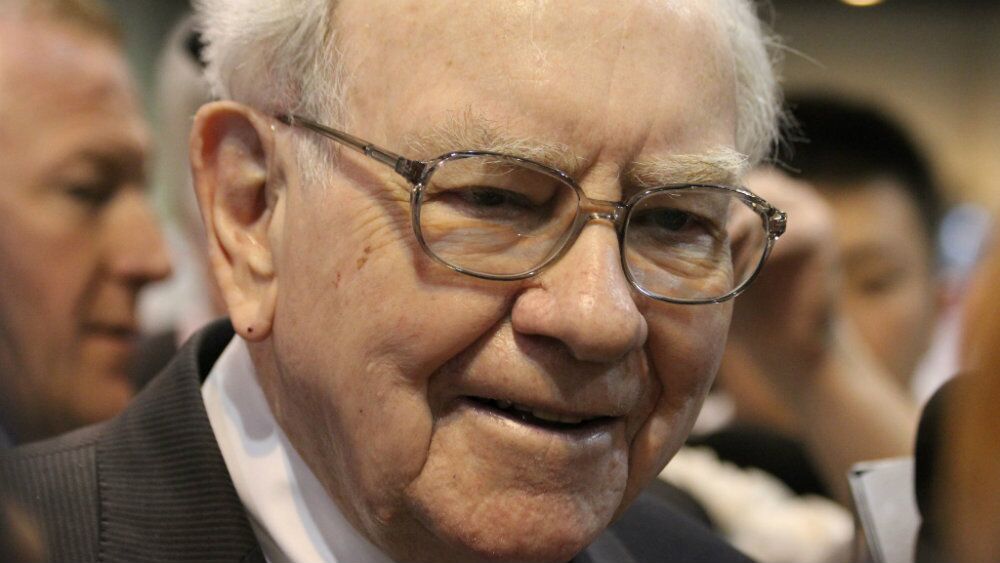

When Warren Buffett makes a move, savvy investors pay attention. And right now, the Oracle of Omaha is making waves by stockpiling a record US$325 billion in cash at Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) while trimming positions in blue chips like Apple and Bank of America. For Canadian investors watching from north of the border, the rising cash pile by one of history’s greatest investors raises a few interesting questions.

While the S&P 500 continues to hit all-time highs, Buffett — a long-time bull on American businesses — has been a net seller of stocks for eight straight quarters, unloading US$166.2 billion worth of equities. His recent US$550 million investment in Domino’s Pizza (NASDAQ:DPZ) is a rare exception, suggesting Buffett sees value in the beaten-down restaurant chain.

Does Warren Buffett expect the market to crash?

The message from Oracle seems clear: In the end, valuations drive long-term prices. With the Shiller price-to-earnings (P/E) ratio hitting its third-highest level in over 150 years and Buffett’s favourite market indicator (total market cap-to-GDP) at all-time highs, the legendary investor appears to be keeping his powder dry for better opportunities.

For Canadian investors, Buffett’s move might offer a masterclass in patience. While Buffett does not predict doom, he has famously advised people never to bet against America. In 2024, his actions suggested that waiting for better prices might be a solid option, given valuations are frothy and expensive.

For instance, today, Apple trades at a trailing P/E ratio of 38 times, compared to just 15 times when Berkshire first brought the hardware giant in 2015. Buffett is now cautious about Apple due to its decelerating growth rates and sluggish consumer demand in China.

It’s entirely possible that the equity markets will pull back in the near term, allowing investors to buy quality companies at a fair valuation. Buffett’s current strategy reminds us that sometimes the best position is cash until truly compelling opportunities emerge.

Perhaps it’s time for investors to review their own portfolio valuations and consider whether keeping dry powder might be wise, even as markets continue their upward march.

Is this Warren Buffett stock undervalued?

Valued at a market cap of US$13.9 billion, Domino’s is the latest addition to Berkshire’s portfolio. What might seem like a restaurant stock is a brand powered by technology and a widening supply chain moat.

In the last 12 months, Domino’s reported revenue of US$4.66 billion, up 4.4% year over year. However, revenue originating from company-owned stores was less than US$400 million. Its major revenue streams include franchise royalties and fees, supply chain sales, and advertising.

Analysts tracking DPZ stock expect revenue to reach US$5.03 billion in 2025, indicating that top-line growth is set to reaccelerate over the next 12 months. Comparatively, adjusted earnings are forecast to expand from US$14.66 in 2023 to US$17.6 in 2025. So, priced at 22.9 times forward earnings, DPZ stock is not too expensive, given consensus growth estimates.

Domino’s has an asset-light business model, which should allow it to increase free cash flow (FCF) from US$485 million in 2023 to US$700 million in 2026. So, if DPZ stock is priced at 25 times trailing FCF, it will trade around $600 per share in early 2027, indicating an upside potential of almost 50% from current prices.

Analysts remain bullish and expect DPZ stock to surge over 20% in the next 12 months.