I’ve said this before, but when it comes to a buy-and-hold-forever exchange-traded fund (ETF), it really just comes down to low fees and broad diversification.

That said, with the S&P 500 index becoming increasingly concentrated in tech and looking overvalued, it’s worth considering reasonable alternatives. One area I like is dividend-growth ETFs—funds that focus on blue-chip stocks you might have forgotten about but that continue to reward investors over time.

Here are two from Hamilton ETFs that fit the bill for a $1,000 investment. Even better, both have 0% management fees for the first year.

Canadian dividend champions

For Canadian stocks, the ETF to buy is Hamilton CHAMPIONS™ Canadian Dividend Index ETF (TSX:CMVP).

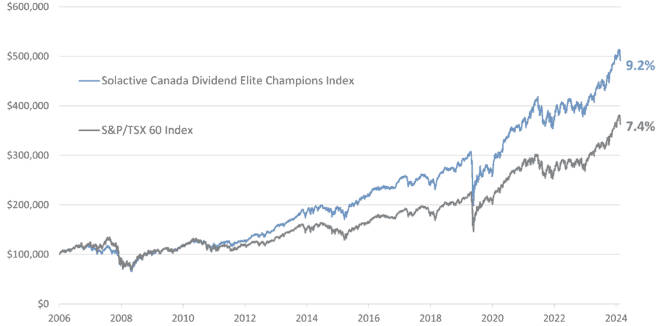

This fund tracks the Solactive Canada Dividend Elite Champions Index, which screens for Canadian stocks with at least six consecutive years of dividend growth and weights them equally.

The result is a portfolio of high-quality dividend growers that provide stability and income. It’s made up of blue-chip Canadian stocks—many of which you might already own—but with CMVP, you get them all in one ticker, with no management fees for the first year and monthly payouts.

Historically, this index has outperformed the S&P/TSX 60, delivering higher returns with lower risk and a better yield.

U.S. dividend champions

With $500 in CMVP, I’d complement it with $500 in Hamilton CHAMPIONS™ U.S. Dividend Index ETF (TSX:SMVP).

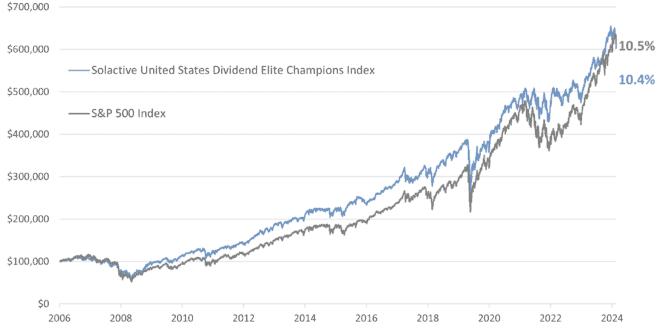

This fund follows the same concept but focuses on U.S. dividend champions. It tracks the Solactive United States Dividend Elite Champions Index, which requires +25 consecutive years of dividend growth—a level of consistency that only the most reliable companies can maintain.

The portfolio is made up of household-name U.S. brands you likely use every day, with less exposure to high-flying tech stocks and a heavier focus on defensive sectors like healthcare, consumer staples, and industrials.

Historically, the index SMVP tracks has matched the S&P 500 in total returns but with lower volatility and a higher yield. That makes it a strong choice for investors looking for long-term stability without giving up growth.

The Foolish takeaway

I think a $1,000 portfolio split equally between SMVP and CMVP is a great way to get exposure to blue-chip dividend growers across North America. With 0% management fees for the first year, it’s an even better deal.