The best dividend exchange-traded funds (ETFs) do not only provide steady income – they also deliver strong total returns. That means when you reinvest the dividends, your long-term gains should be comparable to, if not better than, a broad market ETF.

There aren’t many ETFs that fit this profile, but if you’re investing in a Registered Retirement Savings Plan (RRSP) – a tax-advantaged Canadian account in which U.S. stock and ETF dividends aren’t subject to the usual 15% withholding tax – there’s one I particularly like.

An Aristocratic Dividend ETF

The ETF in question is the ProShares S&P 500 Dividend Aristocrats ETF (NYSEMKT:NOBL).

NOBL tracks an equal-weighted index of S&P 500 companies that have increased their dividends for at least 25 consecutive years. These aren’t just any dividend stocks – they’re blue-chip businesses with the financial strength to keep raising payouts through market crashes, recessions, and economic downturns.

Think about what it takes for a company to never cut its dividend for 25-plus years. It needs a durable competitive advantage, strong cash flow, and disciplined management that prioritizes shareholders – even when times are tough. These are the kinds of stocks that not only pay dividends but keep growing them, making them ideal for long-term investors.

NOBL packages all of these high-quality dividend growers into a single ETF with a 0.35% expense ratio. Right now, it pays a 2% yield, which might not seem like much at first. But as you’ll see shortly, its performance has been exceptional, proving that dividends and growth can go hand in hand.

Historical Performance of NOBL

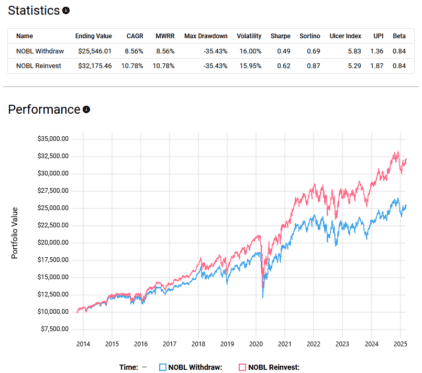

If you had bought NOBL at its inception on October 10, 2013 and held it through March 10, 2025, your results would have varied significantly depending on whether you reinvested dividends or withdrew them.

If you had withdrawn dividends, your investment would have grown to $25,546.01, delivering an 8.6% annualized return. If you had reinvested dividends, your investment would have grown to $32,175.46, with an annualized return of 10.8%.

This highlights the importance of total return. While NOBL’s 2% yield might seem low, the real power comes from its consistent dividend growth and reinvestment effect. Many investors overlook high-quality dividend ETFs because they focus too much on yield alone – or they chase higher-yielding funds that sacrifice long-term growth.

As NOBL’s performance shows, dividend investing isn’t just about collecting payouts – it’s about owning companies that grow both their share price and their dividends over time.