Donald Trump’s latest round of tariff threats on Canada will likely rattle certain industries more than others, especially those tied directly to cross-border trade and logistics.

Expect to see higher volatility in transport sectors like railways and trucking. These companies thrive on the smooth flow of goods between the U.S. and Canada.

When tariffs are introduced or even just threatened, they create uncertainty around demand, disrupt pricing, and force companies to navigate costlier or slower trade routes. All of that can squeeze margins, lower profitability, and reduce investor confidence.

But not every part of the market is equally exposed. In fact, one sector I view as relatively resilient and still attractive is the Canadian financial sector.

It’s the cornerstone of the TSX, with well-capitalized banks, insurers, and asset managers that generate revenue largely from domestic operations—lending, mortgages, and wealth management—not moving freight across the border.

I remain bullish on this sector. Here’s one exchange-traded fund (ETF) that lets you own the biggest players in Canadian finance—virtually fee-free for the time being.

What’s in the Canadian financial sector anyway?

Canada has a vibrant fintech scene, but most of those startups are still privately owned. When it comes to publicly listed financial stocks, the landscape is dominated by established companies with proven business models and long histories of stable earnings.

Broadly speaking, Canadian financials fall into three main categories.

First, you have asset managers, which are firms that manage money for individuals, pension plans, and institutions through mutual funds and other investment products.

Then there are the banks, which provide everyday financial services like deposits, loans, mortgages, and credit cards—this group makes up the lion’s share of the sector.

And finally, you have insurance companies, which offer life, property, and casualty coverage, along with group benefit plans and wealth products.

There’s also a motley mix of smaller players, including holding companies, specialty lenders, investment dealers, and stock exchanges that fill in the rest of the sector.

Overall, Canadian financial stocks tend to offer higher dividend yields and stronger long-term growth than most other sectors on the TSX—making them a cornerstone for income-seeking and buy-and-hold investors alike.

Buy the biggest with this ETF

If you want exposure to Canadian financials without the headache of stock picking, consider Hamilton Canadian Financials Index ETF (TSX:HFN).

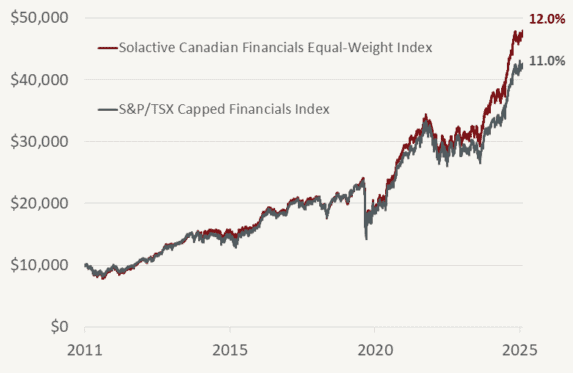

This ETF tracks the Solactive Canadian Financials Equal-Weight Index, which holds equal weightings of the 12 largest financial services companies in Canada. That means you’re not overexposed to just the Big Five banks—your money is spread out more evenly across the sector.

Historically, this equal-weight benchmark has outperformed the S&P/TSX Capped Financials Index, which leans more heavily on the largest banks. The broader, more balanced approach can help reduce concentration risk and boost long-term returns.

Best of all, HFN currently waives its management fee to 0% through January 31, 2026, making it a cost-effective way to own the biggest names in Canadian finance.