You might not immediately think of financial stocks as stable investments, and that’s fair. Just look back to 2008, when even the biggest U.S. banks saw their share prices drop by nearly 50% amidst the global financial crisis.

But I’d ask you to consider an exception for Canadian financial stocks listed on the TSX. Canada weathered the global financial crisis far better than most, thanks to stricter regulations, disciplined risk management, sensible underwriting, and careful liquidity practices. That resilience hasn’t gone away.

Today, with U.S. tariff talk heating up under Trump and pressure building on cyclical sectors like energy and transportation, I think Canadian financials could stay relatively insulated. Their business models rely more on domestic-based stable lending and fee-based services than global trade flows.

Here’s how I’d invest a $7,000 Tax-Free Savings Account (TFSA) contribution into Canadian financial stocks for long-term stability.

Understanding the Canadian financial sector

If you’re thinking about investing in Canadian financial stocks, it’s helpful to first understand what kinds of companies make up the sector.

Most of the well-known names on the TSX are large, established firms with stable business models and long track records of profitability. While Canada has a growing fintech scene, many of those companies are still private and not yet accessible to everyday investors.

For public investors, though, the financial sector is mostly split into three major groups.

The biggest chunk is the banks. These companies handle everyday services like chequing accounts, mortgages, business loans, and credit cards. They’re highly regulated and form the backbone of Canada’s financial system.

Then there are the insurance providers. These firms offer coverage for life, health, property, and vehicles. Many also manage large pools of capital and offer investment products like annuities and group benefits.

Finally, you’ve got asset managers. These companies invest money on behalf of individuals, pensions, and institutions. They make money from management fees tied to mutual funds, exchange-traded funds (ETFs), and other financial products.

There’s also a smaller slice of the sector made up of specialty lenders, exchanges, and investment firms that don’t fit neatly into the three main buckets.

Regardless of which group you invest in, you can almost universally expect steady earnings, reliable dividends, and exposure to a highly regulated and systemically important part of the Canadian economy.

An easy, low-cost way to own Canadian financial stocks

If you want exposure to Canadian financials without the headache of stock picking, consider the Hamilton Canadian Financials Index ETF (TSX:HFN).

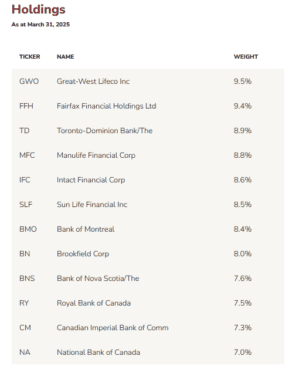

This ETF tracks the Solactive Canadian Financials Equal-Weight Index, which spreads your investment evenly across the 12 largest financial services companies in Canada. That means you’re not overly reliant on just the Big Five banks—your money is more evenly diversified across the sector.

The broader, equal-weight approach has historically outperformed the S&P/TSX Capped Financials Index, which leans more heavily on the biggest banks. Reducing concentration risk can help improve long-term returns and smooth out volatility.

Even better, HFN is currently waiving its management fee—bringing the cost down to 0% through January 31, 2026. That makes it one of the most cost-effective ways to gain exposure to the financial backbone of the Canadian economy.