Supported by their utility-like cash flow, Canadian pipeline stocks have been staples in dividend investors’ income-oriented portfolios, and they usually deliver. Since resuming a dividend growth marathon in 2022 and turning from a monthly dividend payer to traditional quarterly payouts, Pembina Pipeline (TSX:PPL) has remained true to its passive-income-generating mandate in Canadian investors’ retirement portfolios. A role it is taking seriously in 2025 as management raises quarterly dividends by 3% for June 2025 to yield 5.5% annually.

Pembina Pipeline stands out as my top pick for income-focused investors in 2025, especially as the pipeline stock experiences a temporary dip following a 6% after-earnings dip in May. But don’t mistake this pullback for a troublesome weakness. For long-term investors, this looks like a golden opportunity to pick up shares in a resilient, high-quality business at a discount.

Moats built on steel and long-term contracts

Pembina is no ordinary energy company. The $30 billion Canadian pipeline stock operates critical infrastructure that transports oil, natural gas, and natural gas liquids. Think of it as a toll road of the North American energy world. Regardless of what commodity prices do, Pembina still gets paid.

The pipeline stock’s cash flow remains resilient because the majority of its earnings are underpinned by long-term, take-or-pay or fee-for-service contracts. These agreements ensure predictable cash flows and shield the pipeline stock from commodity price volatility and short-term demand shocks. In its recent first quarter (Q1 2025) earnings presentation, about 5% of the company’s adjusted EBITDA is exposed to commodity prices, a testament to its earnings and cash flow stability.

Tariff-proof cash flows

Unlike some TSX income stocks, Pembina’s cash flow is minimally impacted by inflation or tariff changes. The company doesn’t expect any meaningful impact from U.S. tariffs on Canadian energy imports on its books in 2025.

There are ongoing discussions concerning proposed Canada Energy Regulator (CER) tariff adjustments affecting the Alliance Pipeline rates. However, the effect on consolidated cash flows could be contained, thanks to Pembina’s diversified asset base and the nature of its tight commercial agreements.

Even better, the company is benefiting from rising volumes in its gas processing and pipelines segments. In Q1 2025, Pembina posted record gas processing volumes and solid growth in its marketing business, clear signs that demand for its services remains strong despite broader market headwinds.

Pembina’s commitment to growing dividend income

Pembina has a stellar track record of returning capital to shareholders. The pipeline stock has increased its dividend by a cumulative 9% over the past four years, retaining its place among the prestigious S&P/TSX Canadian Dividend Aristocrats index. Management reiterated its commitment to sustainable dividend growth during the latest earnings call.

With a conservative free cash flow per share payout ratio of approximately 62% and growing cash flows, Pembina Pipeline stock is in excellent shape to continue rewarding shareholders with growing dividends over the next decade.

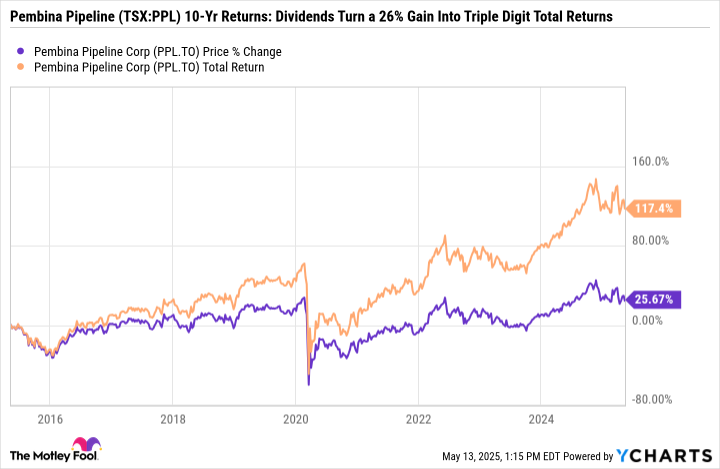

Pembina Pipeline’s dividends have been especially generous lately. They turned a low 25.7% capital gain into a staggering 117% total return during the past decade, with dividend reinvestment.

Investor takeaway

Pembina Pipeline isn’t a flashy tech stock, but it offers something many investors crave today: stable, growing income backed by real assets and long-term contracts. While the market may fret over uncertain contractual changes at Alliance and potentially weaker commodity prices, Pembina stock keeps doing what it does best – generating recurring free cash flows and paying growing dividends that income investors will love for years to come.