Ray Dalio is one of the most famous investors alive. He founded Bridgewater Associates, one of the world’s largest hedge funds, and pioneered the idea of building a portfolio that can perform well in any economic environment. His flagship creation? The All Weather Fund.

At its core, the All Weather Fund is a risk parity strategy. This is a fancy way of saying it balances asset classes not by how much money goes into each one, but by how risky they are. It typically combines stocks, long-term government bonds, inflation-linked bonds, commodities, and gold in a way that aims to handle everything from inflation to recession.

The catch? It’s complex, expensive, and off-limits to regular investors like you and me. Fortunately, a new ETF trading on the Toronto Stock Exchange (TSX) offers a similar concept in a simple, affordable package.

It’s called the Hamilton Enhanced Mixed Asset ETF (TSX:MIX), and it’s unlike most all-in-one ETFs on the market. Here’s why.

How MIX Works

MIX keeps things simple on the surface: 60% in U.S. stocks (via the S&P 500), 20% in long-term U.S. Treasury bonds, and 20% in gold.

These assets play very different roles. Stocks drive long-term growth, treasuries tend to shine during economic slowdowns or deflation, and gold acts as a potential hedge during inflationary shocks or when financial markets lose confidence.

Because these asset classes do not all move in the same direction at the same time, the MIX portfolio strategy benefits from low correlation, which helps reduce volatility.

While MIX is still tilted toward growth through its equity exposure, the addition of bonds and gold gives it a natural defensive layer. In scenarios in which stocks fall, Treasuries often rise. And when both stocks and bonds struggle, like in 2022, gold can help fill the gap.

How MIX Uses Leverage

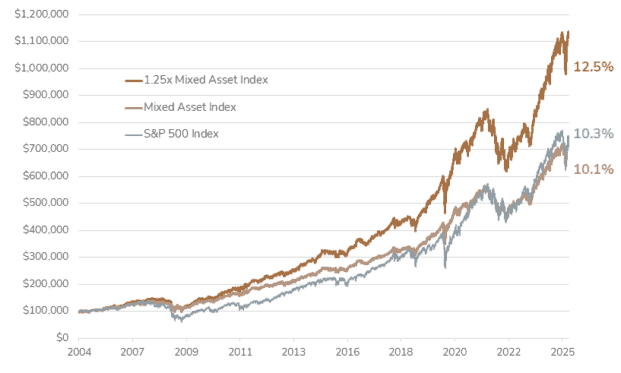

MIX uses leverage, but not in the aggressive way you might see in 2 timees or 3 times ETFs designed for day trading. For every $100 in assets, Hamilton borrows $25 more, like a margin loan, and invests it back into the portfolio for 1.25 times leverage.

That means the actual exposure isn’t 60/20/20. It’s 75% S&P 500, 25% Treasuries, and 25% gold, maintaining the original asset weights while boosting the portfolio’s total exposure by 25%.

Why does that matter? Because according to modern portfolio theory, this approach can theoretically deliver similar returns to a 100% stock portfolio, but with lower overall risk, thanks to better diversification.

How Much Does MIX Cost?

MIX charges 0% in management fees until April 30, 2026, and 0.35% after that. The underlying ETFs it holds are low-cost index funds, mostly U.S.-based, so the embedded costs are modest.

But because MIX uses leverage, the total management expense ratio (MER) will likely be higher than your typical all-in-one ETF, due to borrowing costs. That said, Hamilton can borrow at far lower rates than you’d ever get through your own margin account, which helps keep the cost of leverage much more efficient than DIY investors could replicate.

In short, MIX offers an elegant way to get exposure to stocks, bonds, and gold in a single TSX-listed ETF, optimized for the long haul, with a nod to the same strategy that made Ray Dalio a billionaire.