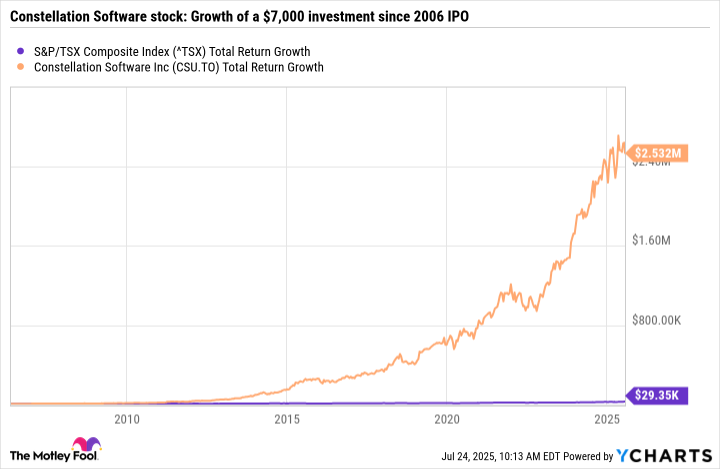

Imagine turning a $7,000 investment into a staggering $2.5 million position, entirely within the tax-free haven of your TFSA. That’s the remarkable reality for investors in Constellation Software (TSX:CSU) stock over the past two decades – a mind-boggling total return exceeding 36,000%. While replicating that exact feat might be a tall order, a spun-off company following the same powerful blueprint strategy could be poised for significant long-term growth, making it a compelling candidate for your own TFSA. That TSX technology stock is Topicus.com (TSXV:TOI), and it’s grabbing serious attention this week as the top performer on the TSX’s Top Tech 50 list.

Topicus.com isn’t just riding a growth wave; it’s actively building one. Much like its former parent Constellation Software, Topicus focuses on acquiring, managing, and building specialized vertical market software businesses – essential software solutions tailored for specific industries. While Constellation conquered North America, Topicus.com is methodically applying the same winning strategy across diverse markets in Europe. Canadian investors seeking long-term growth within their TFSA may find Topicus’s focused approach appealing.

Why Topicus.com stock deserves a place in your TFSA

The tech stock’s early results are promising. Topicus.com spun off from Constellation in early 2021, and early investors are already sitting on gains nearing 200%. More importantly, the underlying business is firing on all cylinders.

Topicus.com’s first-quarter 2025 results showcased impressive momentum. Revenue surged 16% year-over-year to €355.6 million (about $569 million CAD), driven by strategic acquisitions and a solid 4% organic growth rate. Earnings per share jumped an even more impressive 36.4% to €0.30.

But the real story, the fuel powering Topicus.com’s growth engine, is its free cash flow (FCF). This crucial metric represents the cash a company generates after accounting for operating expenses and capital expenditures — the actual cash-based profit available for reinvestment, dividends, or debt repayment. Topicus generated a staggering €271.4 million in cash flow from operations during the first quarter, leading to free cash flow of €161.7 million ($258.8 million CAD), a 21% year-over-year increase.

This torrent of free cash flow is the lifeblood of Topicus.com’s growth strategy. It allows the TSX tech stock to aggressively pursue acquisitions without constantly needing external financing.

For example, during the first quarter, Topicus.com completed acquisitions totaling €39.4 million ($63 million CAD). With quarterly FCF exceeding €161 million, Topicus has the capacity to significantly ramp up its deal-making. It could could have quadrupled its acquisition spend just from the first quarter FCF alone!

This self-sustaining model is precisely how Constellation built its empire. Long-term oriented TFSA investors may wish to check Topicus.com stock out before fully deploying their $7,000 contribution room for 2025.

TOI stock valuation and the Constellation blueprint

To be clear, TOI stock carries a premium valuation. Its forward price-to-earnings ratio (P/E) sits around 69, higher than the industry average of 52. However, looking solely at earnings misses the bigger picture fueled by cash. When you consider its phenomenal cash generation, Topicus.com stock looks far more reasonably priced. Its price-to-free-cash-flow (P/FCF) multiple is 38.6, significantly cheaper than the North American industry average of 66. Similarly, its enterprise value-to-free-cash-flow (EV/FCF) multiple of 25 compares very favourably to the industry average of 56.

The big question for TFSA investors is: Can Topicus.com replicate the phenomenal success of Constellation Software stock?

The potential for Topicus.com stock to widely outperform the TSX is certainly there. Topicus still operates under Constellation’s guidance, and it is using the exact same proven playbook. The company’s core strategy of acquiring essential, niche software businesses is time-tested. Chances of outright failure seem low.

However, tempering expectations is prudent. Europe presents different market dynamics than North America. More crucially, the timing is different. Constellation began its acquisition spree 30 years ago in 1995 and survived the aftermath of the dot-com bust, finding bargains when tech valuations were depressed. Topicus is executing its strategy in the artificial intelligence (AI) era, where software valuations are generally higher. While the strategy is sound, expecting an identical 36,000% return over the next 20 years is potentially unrealistic.

TFSA investor takeaway

Topicus.com stock represents a fascinating opportunity for TFSA investors seeking long-term, tax-free compound growth. It possesses a powerful engine: the proven Constellation Software acquisition strategy, now focused on the European market, and fueled by rapidly growing, substantial free cash flow. This internally generated cash allows the technology stock to aggressively fund its own growth, creating a potentially powerful compounding effect within your TFSA.