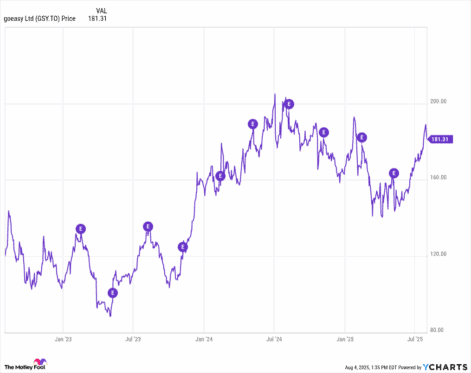

Leading financial services company goeasy (TSX:GSY) will announce its second-quarter (Q2) results after the market closes on Wednesday, August 6. Heading into the earnings, this Canadian stock has been on a decent upward swing lately, gaining about 13.5% over the past three months, signalling renewed interest from the market.

goeasy, known for providing non-prime leasing and lending services, is likely to benefit from its ability to consistently expand its consumer loan portfolio. While the expansion of its loan portfolio will support its top line, the company’s focus on improving efficiency will cushion its earnings.

Another detail that investors shouldn’t overlook ahead of the earnings is the stock’s recent earnings track record. Despite its operational strengths, goeasy shares have fallen following earnings in each of the last five quarters.

As for Q2, investors should note that the broader economic picture still poses challenges. With ongoing macroeconomic uncertainty, there’s a risk that goeasy may need to set aside more funds for potential loan losses. The move could pressure earnings. In addition, a slight year-over-year decline in its total portfolio yield may continue to affect its profitability this quarter. These developments could potentially lead to volatility in its stock price. Let’s take a closer look.

goeasy: Here’s what to expect from Q2

goeasy is a leader in Canada’s non-prime lending space. With growing market share, solid demand for credit, and an increasingly favourable competitive landscape, goeasy is expected to deliver another quarter of portfolio growth, driving continued revenue expansion.

Management is forecasting a significant jump in consumer loan growth for Q2, with the portfolio expected to expand between $275 million and $300 million. That’s a noticeable acceleration compared to the $190 million increase seen in the previous quarter, signalling strong credit demand and the company’s ability to meet it efficiently.

However, despite this growth, the overall yield on the loan portfolio is expected to come in slightly lower than last year, in the range of 31% to 32%. Notably, this dip in yield isn’t a red flag. It reflects a strategic shift toward a higher proportion of secured loans, which tend to carry lower interest rates but also come with lower credit risk. Additionally, recent changes in credit underwriting, along with a new cap on interest rates, have contributed to the modest decline in yields.

To offset the impact of these lower yields, goeasy is actively optimizing its product mix, pricing, and collection strategies. These measures will enhance efficiency and protect profitability, even as the company adapts to a changing regulatory and competitive environment.

While the near-term shift toward secured lending could temper earnings growth, the long-term outlook remains strong. Secured loans add stability to the portfolio and are expected to support more consistent credit and payment performance over time.

In short, goeasy’s Q2 may reflect a balancing act between short-term yield pressure and long-term portfolio strength.

Should you buy goeasy before August 6?

Whether or not you should buy goeasy before August 6 comes down to your investment horizon. For long-term investors, goeasy continues to present an attractive opportunity. The company’s fundamentals are strong. Its consumer loan portfolio is expected to keep expanding at a healthy pace, which should translate into consistent double-digit revenue growth. On top of that, improvements in operating efficiency are expected to enhance margins, and with credit and payment performance stabilizing, goeasy’s bottom line is looking increasingly resilient.

Another reason long-term investors may find goeasy appealing is its dividend. The company’s ability to generate solid free cash flow gives it the flexibility to sustain its dividend payments and potentially increase them over time. Historically, goeasy has outperformed the broader market, and there’s reason to believe that trend could continue.

That said, for those with a shorter investment window, it might be worth exercising a bit of patience. With Q2 earnings just around the corner, waiting for the results could present a more favourable entry point, especially if there’s a pullback. goeasy has a track record of bouncing back strongly, so a dip could be a smart buying opportunity.