There’s an old investing rule called “buy what you know.” It was popularized by Peter Lynch, the legendary Fidelity fund manager, who often relied on the observations of his wife and kids to spot trends before Wall Street did.

For Canadians, that might mean something as simple as stopping at Tim Hortons on the way to work. You grab your Double Double, and whether you realize it or not, you’ve just interacted with a publicly traded company. Tim’s is owned by Restaurant Brands International (TSX:QSR), which also happens to be the parent company of Burger King, Popeyes, and Firehouse Subs.

There are lots of ways to gauge whether a stock is reasonably priced. It gets easier when you’re looking at a large, profitable, dividend-paying name like QSR. A company that throws off steady cash flow and pays a regular dividend gives you a baseline of quality, which lets you skip some of the deeper forensic work on day one and start with a few quick, telling metrics.

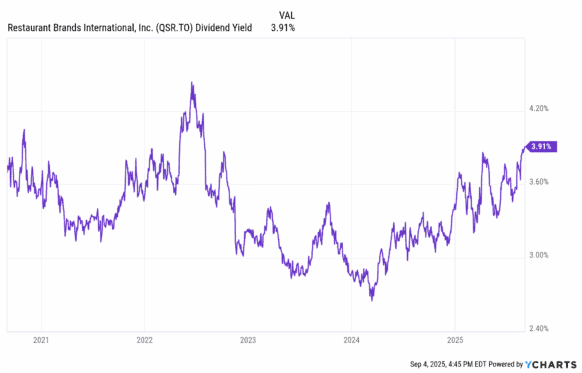

Checking for value – dividend yield

Dividend yield is simply dividends per share over the last 12 months divided by today’s share price. It’s great for judging relative value through time for the same company. All else equal, a lower price or a rising dividend pushes the yield up; a higher price or a cut pulls it down. Think numerator (dividend) over denominator (price).

On QSR, the chart shows a current yield around 3.9%. That sits toward the high end of its five-year range. In 2023, when the yield dipped toward the mid-2s, the stock was pricier on this measure. When it spiked above 4% during 2022’s bear market, it was cheaper.

Today’s ~3.9% suggests QSR is more attractive than it was during the low-yield periods, though not quite as cheap as those brief peaks above 4%. For income-minded investors, that’s a comfortable entry point if you believe dividend growth continues.

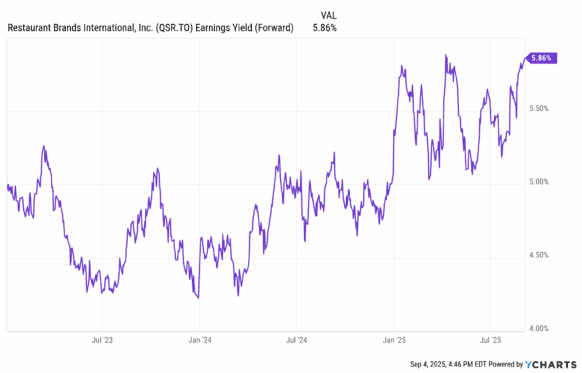

Checking for value – earnings yield

Earnings yield is not a cash payout to you. It’s the inverse of the price-to-earnings (P/E) ratio and tells you how much expected earnings you’re buying for each dollar invested. Forward earnings yield uses next-12-months earnings-per-share (EPS).

The chart shows QSR at about 5.9% today. Flip that over and you get a forward P/E near 17 (1 ÷ 0.0586 ≈ 17.1). For a global, franchise-heavy quick-service operator, that’s a reasonable multiple. It implies an earnings yield premium of a few percentage points over short-term risk-free rates, with upside if the company grows same-store sales and keeps opening franchised units.

A near-4% dividend yield and a ~6% forward earnings yield point to QSR being fair to slightly undervalued versus its own recent history. If you expect steady dividend increases and mid-single-digit EPS growth, those starting yields set you up for a solid total-return profile without needing heroic assumptions.

The Foolish takeaway

QSR is not a deep bargain, but it doesn’t look expensive either. With the dividend yield sitting near 3.9% and the forward earnings yield close to 6%, the stock looks fairly valued to slightly undervalued at current levels. For a global operator with steady cash flow, a history of dividend growth, and a durable brand portfolio, that’s a decent setup for investors seeking a mix of income and long-term compounding.