Have you heard about the 4% rule for retirement? It’s the idea that if you withdraw 4% of your portfolio each year, adjusted for inflation, your savings should last for at least 30 years. There are variations and debates over the number, but the core principle is the same: don’t overspend what your portfolio can sustainably generate.

This is easier if you own Canadian dividend stocks, especially those yielding over 5%. Qualified dividends are tax-efficient in non-registered accounts and can provide a steady cash flow without the need to sell shares. One TSX blue-chip company I like using as a case study for income investing is Enbridge (TSX:ENB).

What is Enbridge?

Enbridge is technically classified as an energy stock, but in many ways it operates like a utility. It owns one of the largest networks of oil and natural gas pipelines in North America, along with natural gas utilities and renewable power assets.

Its revenue comes primarily from transporting energy, which is billed on a contracted or regulated basis. That means Enbridge gets paid regardless of commodity prices, similar to how a utility charges for electricity delivery.

From an investment standpoint, Enbridge does carry a lot of debt, but that’s expected for infrastructure-heavy businesses. Building pipelines and energy infrastructure requires billions of dollars upfront.

Once completed and contracted, though, these assets generate steady cash flows for decades. That cash flow, in turn, is distributed to investors in the form of quarterly dividends.

Enbridge dividend

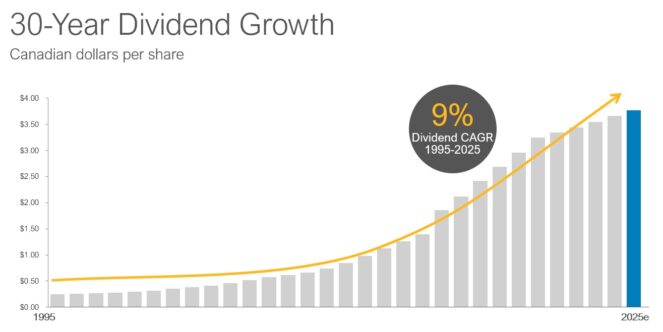

Enbridge has one of the longest dividend track records in Canada, paying shareholders for more than 70 years. In December 2024, it announced a 3.0% dividend increase, raising its quarterly payout to $0.9425 per share. That works out to $3.77 per share annually for 2025. Over the past 30 years, Enbridge’s dividend has grown at an impressive 9% compound annual growth rate.

The company also emphasizes balance. Its payout ratio—how much of its distributable cash flow goes to dividends—remains within a 60-70% range. That leaves room to reinvest in new projects while still rewarding shareholders.

For investors, the next dividend payment is scheduled for December 1 to shareholders of record on November 15. At today’s share price of $69.28, that $3.77 annual payout represents a forward yield of about 5.4%. Remember, if the stock price falls, the yield goes higher, assuming the dividend stays unchanged.

The Foolish takeaway

As solid as Enbridge is, it shouldn’t be your entire retirement income strategy. The lesson here is to focus on durable, wide-moat businesses with steady cash flows that return value to shareholders through reliable, growing dividends. Owning a mix of companies like this—and holding them through market ups and downs—can help you retire with confidence.