Here’s the bottom line up front: no, Algonquin Power & Utilities Corp. (TSX:AQN) is not a good dividend stock to buy if your goal is making money from your investments.

The company is still struggling with negative leveraged free cash flow, a dangerously high debt-to-equity ratio, and an unsustainable payout when measured against distributable cash flow. On top of that, management has repeatedly diluted shareholders, treating them as a lifeline rather than partners.

If your reason for looking at AQN is to secure high dividend yields from utilities, there are better choices. One exchange-traded fund (ETF) that holds a basket of leading utilities and pays an attractive monthly yield is the Hamilton Enhanced Utilities ETF (TSX:HUTS). Here’s why I like it.

How HUTS works

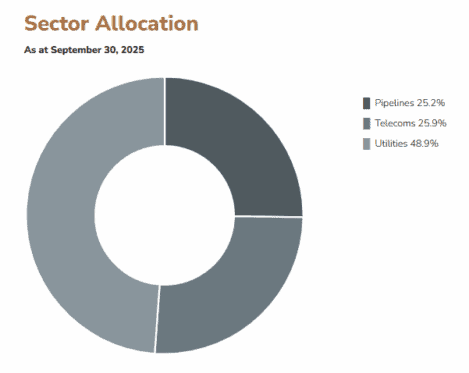

HUTS tracks the Solactive Canadian Utility Services High Dividend Index, but this index takes a broader, more forward-looking view of “utilities” than traditional benchmarks.

Instead of limiting itself to regulated power and gas companies, it also includes pipelines – technically classified under energy – and telecom companies, which fall under communications.

That matters because pipelines behave much like utilities, with regulated, tollbooth-style cash flows. Telecom companies also fit the profile, offering essential services with recurring revenues and strong dividend histories.

By blending utilities, pipelines, and telecoms, the index captures a wider set of essential service providers, creating a more diversified and resilient portfolio than the traditional S&P/TSX Capped Utilities Index, which is narrower and more exposed to power and gas.

HUTS leveraged explained

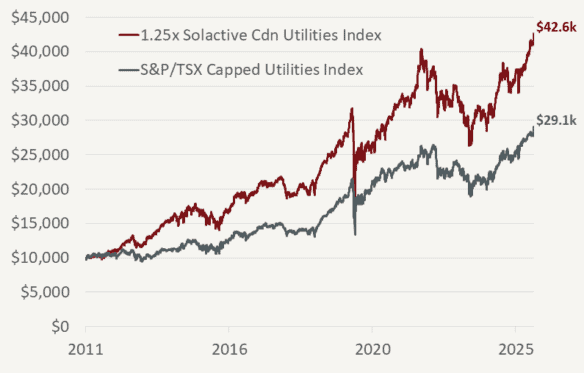

HUTS employs modest leverage of 1.25 times. For every $100 invested, the fund borrows another $25 at institutional rates. That leverage allows you to own more of the underlying stocks without managing margin yourself, and unlike borrowing directly, it can be held inside registered accounts like a TFSA or RRSP.

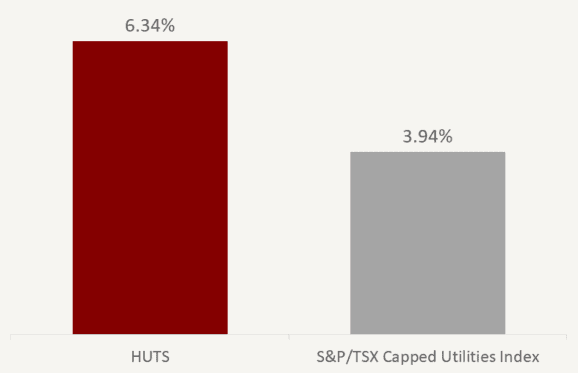

The effect is magnified exposure – both on the upside and downside – but also higher yield. Right now, HUTS pays a 6.3% distribution yield with monthly payouts.

Moreover, the Solactive Index it tracks has historically outperformed the better-known S&P/TSX Capped Utilities Index in both yield and raw performance after factoring in the 1.25 times leverage.

The Foolish takeaway

Don’t pin your dividend income on a single, heavily indebted, and poorly managed utility. An ETF like HUTS spreads risk across the sector and uses modest leverage to boost income, giving you monthly yield without the baggage of companies like Algonquin.