Thanks to exchange-traded funds (ETFs), you can buy hundreds of stocks with a single click. Many ETFs are market-cap weighted, which means the bigger a company is—measured by share price times shares outstanding—the more weight it carries.

Over time, this naturally results in the strongest companies rising to the top, saving you from having to guess which stocks to pick. That’s why if you have $500 to invest and want to get started, my advice is not to bet it all on one or two names. Instead, buy the whole haystack—and in Canada, that haystack is the S&P/TSX 60 Index.

What is the S&P/TSX 60?

The S&P/TSX 60 is a stock market index that tracks 60 of the largest publicly traded companies in Canada. It’s considered a benchmark for the Canadian equity market because it covers roughly 70% of the total market capitalization of the Toronto Stock Exchange.

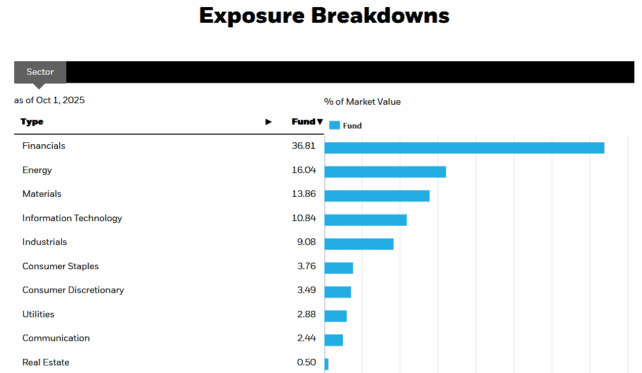

Unlike smaller or more specialized indices, the S&P/TSX 60 includes leaders from across the economy—financials, energy, industrials, materials, consumer staples, telecommunications, and more.

Because it focuses on large-cap companies, the index tends to tilt toward stable, established businesses that generate consistent cash flow and often pay dividends. It’s not meant to capture every Canadian stock, but rather the most influential ones that drive the bulk of the market’s performance.

How to invest

The easiest way to invest in the S&P/TSX 60 is through iShares S&P/TSX 60 Index ETF (TSX:XIU). XIU is a passive ETF, meaning it doesn’t try to pick winners—it simply replicates the index in its entirety.

The fund charges a 0.18% management expense ratio (MER). On a $500 investment, that works out to less than $1 per year in fees, automatically deducted from the fund’s performance—not paid out of pocket. Over the last 10 years, XIU delivered an annualized return of 11.79%, assuming dividends were reinvested and no tax was owed.

XIU also pays a quarterly dividend, which currently works out to a trailing 12-month yield of 2.55%. Holding it inside a Tax-Free Savings Account (TFSA) ensures you keep more of that income working for you.

The Foolish takeaway

With only $500 to start, your best move isn’t trying to find the next stock market superstar—it’s buying the whole market. XIU gives you instant diversification, reliable dividends, and a low-cost way to build wealth inside a TFSA. Stay consistent with contributions, reinvest dividends, and let time and compounding do the heavy lifting.