This article first appeared on The Motley Fool’s U.S. website.

Advanced Micro Devices (NASDAQ: AMD) stock was up more than 28% in trading Monday morning after the semiconductor company announced a massive deal with ChatGPT owner OpenAI. The deal calls for OpenAI to take a 10% stake in AMD, worth up to 160 million shares, and will have AMD provide around 6 gigawatts of graphics processing units (GPUs) to OpenAI.

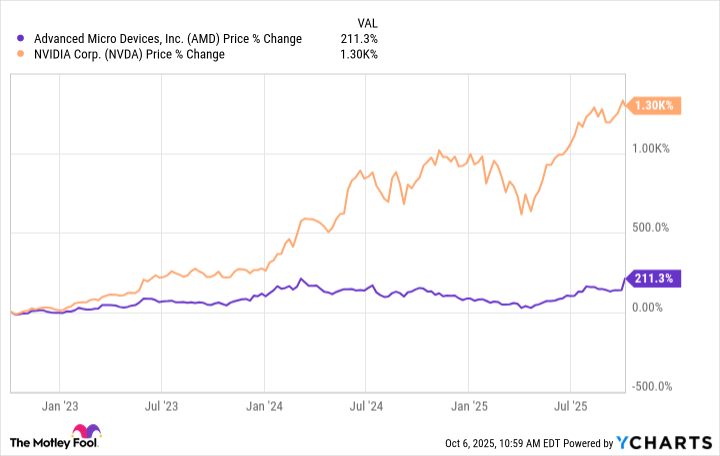

The deal is a huge shot in the arm for AMD, which has been playing second fiddle to Nvidia in the GPU game for the last several years. While Nvidia’s stock is up over 1,300% in the last three years as it became the largest publicly traded company in the world, AMD is up a comparatively soft 200% in the same period.

AMD data by YCharts

But that may be changing. While Nvidia still rules the roost, AMD has been catching up this year. In fact, its stock performance doubled that of Nvidia’s so far in 2025. Will its deal with OpenAI help AMD continue to close the gap?

About the deal

According to AMD, the definitive agreement to power Open AI’s infrastructure will roll out over several generations of OpenAI’s infrastructure, starting with the initial 1 GW purchase of AMD Instinct MI450 GPUs to begin in the second half of 2026.

The deal calls for AMD to issue OpenAI a warrant for up to 160 million shares of AMD common stock that would vest as specific milestones are achieved. The first tranche of the warrant vests with the first 1 GW deployment and continues as OpenAI purchases more GPUs to reach 6 gigawatts.

“We are thrilled to partner with OpenAI to deliver AI compute at massive scale,” AMD CEO Lisa Su said. “This partnership brings the best of AMD and OpenAI together to create a true win-win enabling the world’s most ambitious AI buildout and advancing the entire AI ecosystem.”

AMD’s chief financial officer and executive vice president, Jean Hu, said that AMD’s relationship with OpenAI will deliver “tens of billions of dollars in revenue for AMD.”

The bottom line

The AMD-OpenAI deal is the most recent in a series of transactions made by the nation’s biggest chipmakers as companies race to scale. Nvidia recently announced a $100 billion deal with OpenAI, as well as a US$5 billion stake in Intel, which is competing with AMD in the central processing unit (CPU) space. OpenAI also has a $300 billion deal with Oracle to purchase cloud equipment.

If AMD can realize management’s prediction for tens of billions in additional revenue from its OpenAI deal, AMD stock should remain a viable alternative to Nvidia for investors who are looking to invest in AI infrastructure. And when you consider that AMD has by far outperformed Nvidia in 2025, it appears the stock will continue to have a significant runway for growth.