When you invest for income, it’s important to understand the difference between nominal returns and real returns. Nominal returns are your total gains before inflation. Real returns are what you actually earn once inflation is taken into account.

In Canada, long-term inflation typically runs around 2% in normal years outside of spikes like 2022. If your focus is on dividends, the goal is to make sure your payouts grow faster than that 2% average each year.

It turns out there’s a TSX dividend exchange-traded fund (ETF) designed to do exactly that. It invests in Canadian stocks with a consistent history of year-over-year dividend growth at a rate well above inflation.

My Canadian dividend ETF of choice

There are two main ways to approach dividend investing. One is the high-yield route, where investors chase the biggest payouts they can find, often ignoring whether those dividends are sustainable.

The other is the dividend growth approach, which focuses on companies that raise their dividends consistently year after year. The yields might be smaller, but the payouts are far more reliable.

That’s exactly what you get with the Hamilton CHAMPIONS™ Canadian Dividend Index ETF (TSX:CMVP).

This ETF tracks the Solactive Canada Dividend Elite Champions Index, which includes Canadian companies that have raised their dividends for at least six straight years without a single cut. On average, those companies have grown dividends by 10% per year, making them some of the most dependable income names in the country.

The fund leans toward large, stable businesses, with holdings averaging about $73 billion in market cap. It’s packed with familiar names from Canada’s most reliable sectors – banks, insurers, utilities, pipelines, and railways.

CMVP index performance

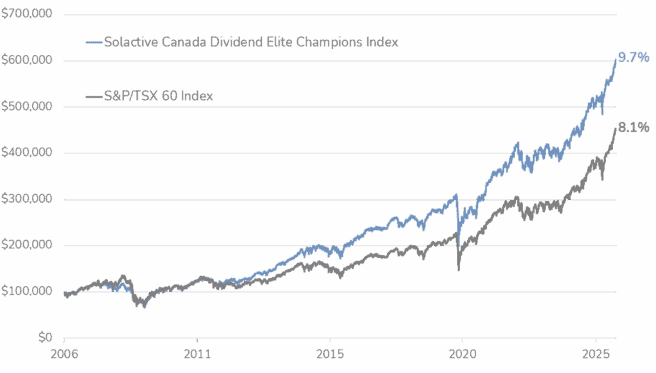

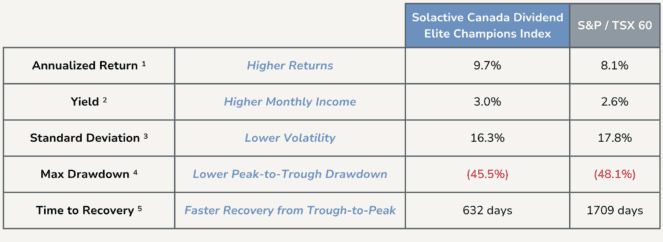

Hamilton’s backtesting shows that the index behind CMVP has outperformed the S&P/TSX 60 over the long term while experiencing less volatility. That means investors would have enjoyed smoother returns and fewer big drawdowns along the way.

It has also produced a higher yield than the TSX 60, which isn’t surprising given its dividend focus. Just as important, the benchmark recovered faster from market dips, a sign of underlying business quality and resilience.

The Foolish takeaway

CMVP’s 2% headline yield may not turn heads, but this ETF isn’t about chasing high payouts. It’s about owning the right mix of growth, quality, and consistency that trumps inflation over the long term.

It’s also worth noting that CMVP is fee-free until January 31, 2026. After that, the management fee will be just 0.19%, keeping it among the lowest-cost dividend ETFs in Canada.