For 2026, despite continued increases in the cost of living for Canadians, the government has decided to keep the Tax-Free Savings Account (TFSA) contribution limit at $7,000.

It’s not ideal, but it’s still one of the most generous tax-sheltered accounts available anywhere. Whenever I talk to U.S. investors, the common theme is how restrictive their tax-advantaged accounts are compared with what Canadians have access to.

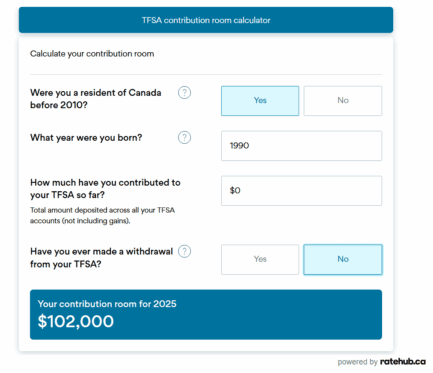

One question I get constantly is simple on the surface but tricky in practice. How do you actually calculate your TFSA contribution room? The honest answer is that it can get complicated. It depends on when you became a resident of Canada, the year you were born, how much you have contributed over time, and whether you have ever made withdrawals.

Fortunately, there are solid tools available to help, including a reliable calculator from MoneySense. Before relying on any tool, though, it helps to understand the basic math behind the maximum amounts.

Calculating TFSA contribution room

Here is the bottom line upfront: the maximum TFSA contribution room that any Canadian can have in 2026 is $109,000, but this assumes four things that may not apply in your specific case.

First, you were a resident of Canada before 2010. Second, you were born in 1990 or earlier. Third, you have never contributed to a TFSA. Fourth, you have never made a withdrawal.

Before adding the new $7,000 limit for 2026, the maximum cumulative room through 2025 is $102,000. Adding the 2026 contribution brings the total to $109,000. Remember, this is the absolute ceiling, not what most people actually have available.

Where many investors run into trouble is tracking contributions and withdrawals. While you can check your TFSA room through the Canada Revenue Agency (CRA) portal, that number is not updated in real time. Even the CRA notes that the figure may be inaccurate.

This is why it helps to keep your own simple spreadsheet that records how much you contribute, when you contribute it, and when you make withdrawals. Doing this consistently can help you avoid overcontributions and unexpected penalties.

What to invest in with a maxed TFSA

Someone with the full TFSA room available in 2026 would likely be born in 1990 or earlier. This investor is probably a millennial who may already have a home, a stable job, and long-term financial goals that include retirement planning.

At this stage, the TFSA often works best as a long-term growth engine. If I were in this position, I would focus on a low-cost, diversified exchange-traded fund (ETF). One option that fits this role well is the BMO Growth ETF (TSX:ZGRO).

This is an all-in-one portfolio that holds 80% in global equities and 20% in bonds. The equity portion provides long-term growth, while the bond allocation helps reduce volatility during market downturns. This balance makes sense for someone who is still 30 years away from retirement but wants a smoother ride than an all-equity portfolio.

Another advantage is cost. The management expense ratio (MER) is about 0.20%. On a $100,000 investment, that works out to roughly $200 per year in fees, which is far lower than what many Canadians pay through traditional bank mutual funds.