The Internet of Things (IoT) represents one of the biggest opportunities for investment in the tech sector, and the innovations brought forth through the IoT are set to revolutionize how we do everyday tasks.

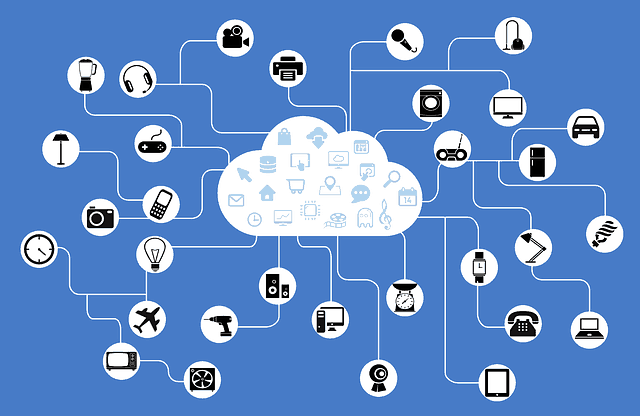

The IoT is the concept of having everyday devices connected to provide information and diagnostics to each other and us. That information is used to perform mundane tasks or macros that can range from your car notifying you that you need to check your engine and scheduling the appointment at the dealership to tapping a button in the laundry room to order more fabric softener.

It’s a very futurist view of the world that is slowly becoming reality. Here are some of the companies behind that revolution and why they are intriguing investment options.

Sierra Wireless, Inc. (TSX:SW)(NASDAQ:SWIR) is the key to the whole IoT puzzle. Sierra designs the embedded modems and modules that are necessary for devices to connect to the internet. The company’s products are already found in a variety of products, including smartphones in dozens of countries around the world.

Sierra has branched out over the past year into the automotive sector, which is another massive sector that is embracing the IoT wave and connectivity overall. Vehicles coming standard with internet connectivity are becoming more of the norm, and manufacturers are moving beyond the initial infotainment appeal of using connectivity to providing updates, diagnostics, and even upgrades to core systems.

As our everyday devices and automobiles become more connected and smart, expect Sierra to continue to grow, representing a massive opportunity in a market that is slated to be measured in the trillions.

BlackBerry Ltd. (TSX:BB)(NYSE:BB) is another company working on expanding into the automotive segment, but in a different way. BlackBerry’s QNX operating system is a stable, secure, and modular system that is perfectly suited to becoming the central brain of the myriad of systems that will make autonomous driving a reality.

Autonomous driving is the next major evolution in driving and is closer to reality than you may realize.

When you look at any recent automobile, the number of technology-based systems are increasing with each passing year. Each of these systems, such as lane-departure warning, adaptive cruise control, cross-traffic monitoring, and countless others are independent systems today that in future will feed into a central unit for real-time processing and decision making.

Another key point is that QNX is already installed in over 60 million vehicles worldwide, powering infotainment systems, and BlackBerry already has a superior record in securing critical systems.

Amazon.com Inc. (NASDAQ:AMZN) is an IoT heavyweight with massive potential. Amazon’s wildly simple yet successful dash buttons are the perfect use scenario for IoT technology — a simple, mundane task — in this case, ordering a product — is completed at a touch of a button.

As intriguing as that sounds, Amazon’s Echo units are leagues ahead in terms of integration and potential. Utilizing speech recognition tied to an intelligent algorithm, the units respond to voice-activated queries, accomplishing simple tasks, ranging from providing general answers to adjusting lighting and environment settings in a connected home.

The possibilities for growth in this realm are nearly endless, as every new device that gets connected to the internet could, in theory, be controlled or accessed through an Echo.