We here at The Fool don’t listen much to Bay Street and Wall Street.

Time and time again, the data shows that professional analysts don’t have much of an edge over individual investors. So, we urge you not to follow them blindly.

That said, it can often be useful to use Wall Street calls as a starting point for further research. As long as the logic supporting the recommendation is sound, there’s no shame in making money from a few of their ideas.

Case in point: Goldman Sachs’s recent note on energy giant Canadian Natural Resources Ltd. (TSX:CNQ)(NYSE:CNQ).

Natural selection

Canadian Natural’s stock performance over the past six months has been anything but spectacular. Lackluster recent results, worries about production, and the company’s overall exposure to soft commodity prices have all weighed on the shares. Moreover, investors aren’t too thrilled with management’s reluctance to buy back stock.

But Goldman analyst Neil Mehta believes all those clouds could provide an opportunity for us. Why? It all boils down to one thing: cash flow.

Despite all the noise surrounding the company, Mehta says that Canadian Natural stands to benefit from strong cash flows this year. Management will be able to use that cash flow to firm up the balance sheet. This, in turn, will allow the company to return more cash to shareholders — be it in the form of dividends or share repurchases.

I wholeheartedly agree with that take.

After all, it’s in line with the bullish analyses of several resource-savvy Fools. And more importantly, it’s completely consistent with the trend of Canadian Natural’s recent fundamentals.

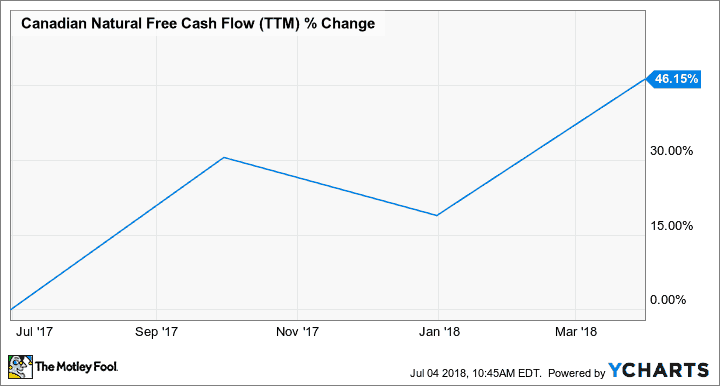

Take a look at the company’s free cash flow growth over the past year:

As regular readers know, we Fools put an extremely high value on free cash flow. So, when it comes to Canadian Natural, we’re all smiles.

Tempting price target

Along with Mehta’s positive note, he reiterated a price target of $43 (roughly $56 Canadian). That represents upside of about 20% from where the shares stand right now. Juicy.

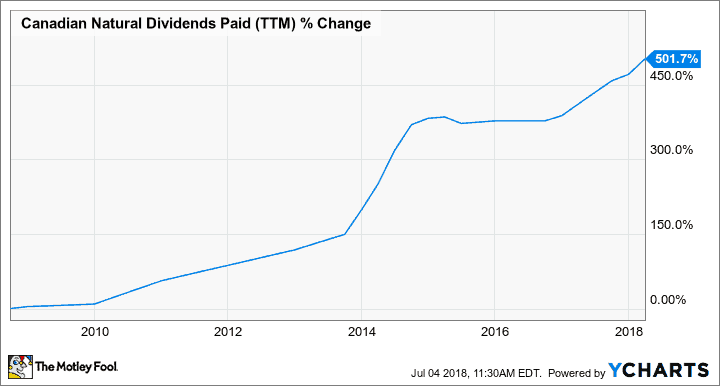

While I never put too much weight on analyst price targets, Mehta’s seems reasonable given Canadian Natural’s dividend yield of 2.8%. That might not look too attractive on its own, but given the company’s free cash flow momentum and impressive history of dividend growth, it seems worth grabbing today.

Throw in the fact that oil prices appear to be firming up, and you have a stock that has several reasons to move higher.

The bottom line

Just because a Wall Street or Bay Street analyst likes a company doesn’t mean that you should like it, too. The most important thing is the reasoning behind why they like (or dislike) a particular stock and whether or not you believe it is sound.

In my opinion, Goldman’s positive rating on Canadian Natural makes a tonne of sense.